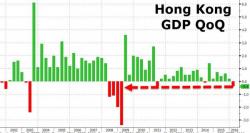

China Hard Landing Spreads: Hong Kong GDP Tumbles At Fastest Pace Since Financial Crisis

In the latest indication of contracting global growth, overnight Hong Kong reported that its Q1 GDP fell off a cliff 0.4% qoq, widly missing estimates of 0.1% growth as retail sales plummeted and the property market continued its collapse. On a y/y basis, the economy grew only 0.8% when compared to the same period last year, less than half the 1.9% y/y growth reflected in Q4.