"Bad News Is Great Again" - Global Stocks Soar After Yellen Admits Global Economy Is Much Weaker

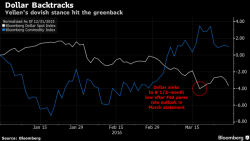

At the end of the day, it was all about the dollar.

At the end of the day, it was all about the dollar.

Submitted by 'Jeremiah Johnson', retired Green Beret, via SHTFPlan.com,

Many of the things that are happening this very moment have direct parallels in literature of the past. Whether it is an account such as the “Gulag Archipelago” by Solzhenitsyn or a work of “fiction” such as “1984” by George Orwell is irrelevant. Elements of the history or the storyline (regarding the former and the latter works) are now becoming thoroughly inculcated into the fabric of modern reality.

With Europe back from Easter break, we are seeing a modest continuation of the dollar strength witnessed every day last week, which in turn is pressuring oil and the commodity complex, and leading to some selling in US equity futures (down 0.2% to 2024) ahead of today's main event which is Janet Yellen's speech as the Economic Club of New York at 12:20pm, an event which judging by risk assets so far is expected to be far more hawkish than dovish: after all the S&P 500 is north of 2,000 for now.

Submitted by Charles Kennedy via OilPrice.com,

Just over three months after the authorities lifted the four-decade ban on crude oil exports, the U.S. has actually exported less this year than it did over the same period the year before, when the ban was still in place.

Excerpted from Doug Noland's Credit Bubble Bulletin,

The 1987 stock market crash raised concerns for the dangers associated with mounting U.S. “twin deficits.” Fiscal and trade deficits were reflective of poor economic management. Credit excesses – certainly including excessive government borrowings – were stimulating demand that was reflected in expanding U.S. trade and Current Account Deficits. Concerns dissipated with the revival of the bull market. These days we’re confronting the consequences of 30-plus years of mismanagement.