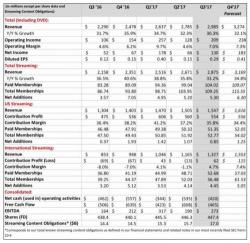

Netflix Jumps After Smashing Subscriber Expectations, Unveils $17 Billion In Content Commitments

After some initial confusion, Netflix stock surged after hours, a repeat of what it did last quarter, soaring above its all time high price, up over 2% after reporting Q3 numbers which while beating slightly on revenues ($2.99Bn, Exp. $2.97Bn), and beating modestly on non-GAAP EPS (GAAP EPS$0.29, non-GAAP EPS $0.37, exp. $0.32), were far more remarkable for the subscriber numbers, which smashed expectations as follows: