![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

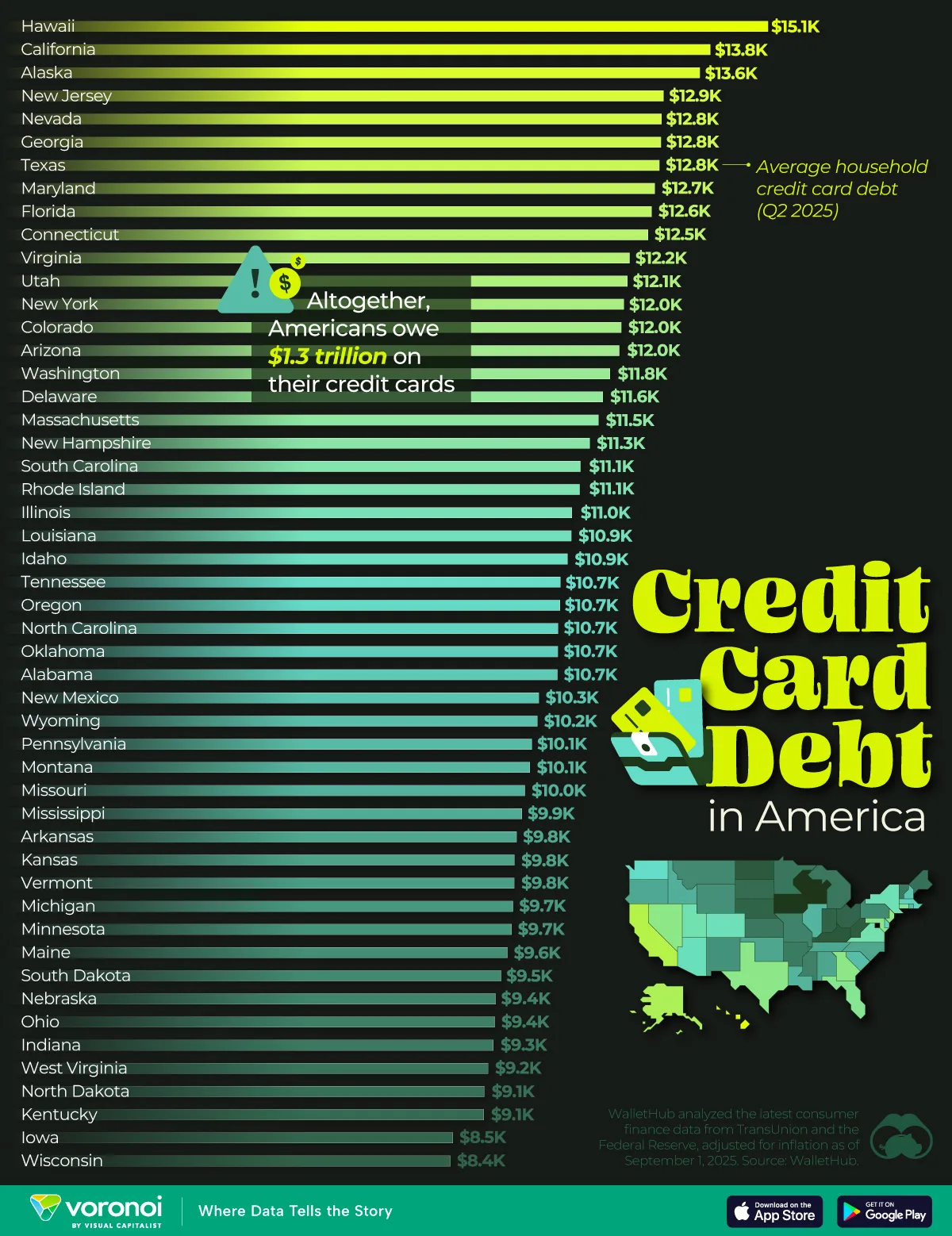

The U.S. States With the Highest Credit Card Debt

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Hawaii leads the nation with $15,052 in household credit card debt, driven by its high cost of living.

- Coastal and Sun Belt states like California, Nevada, Texas, and Florida also carry heavier debt loads.

Americans are carrying a record amount of credit card debt, but where that burden hits hardest varies significantly by geography. This visualization maps household credit card debt across all 50 U.S. states. The data for this graphic comes from WalletHub.

Hawaii Tops the List

America’s total credit card debt now stands at about $1.32 trillion, which includes roughly $65 billion added just in the past year.

Hawaii leads the nation with the highest household credit card debt at $15,052. This figure reflects the state’s high cost of living—especially in housing, transportation, and food—which often forces residents to rely more heavily on credit to cover essentials. Other high-debt states include California ($13,847) and Alaska ($13,630), both with similar affordability challenges.

| Rank | State | Household Credit Card Debt |

|---|---|---|

| 1 | Hawaii | $15,052 |

| 2 | California | $13,847 |

| 3 | Alaska | $13,630 |

| 4 | New Jersey | $12,873 |

| 5 | Nevada | $12,832 |

| 6 | Georgia | $12,819 |

| 7 | Texas | $12,786 |

| 8 | Maryland | $12,690 |

| 9 | Florida | $12,624 |

| 10 | Connecticut | $12,549 |

| 11 | Virginia | $12,164 |

| 12 | Utah | $12,117 |

| 13 | New York | $12,045 |

| 14 | Colorado | $11,991 |

| 15 | Arizona | $11,950 |

| 16 | Washington | $11,755 |

| 17 | Delaware | $11,607 |

| 18 | Massachusetts | $11,515 |

| 19 | New Hampshire | $11,333 |

| 20 | South Carolina | $11,137 |

| 21 | Rhode Island | $11,121 |

| 22 | Illinois | $10,962 |

| 23 | Louisiana | $10,949 |

| 24 | Idaho | $10,871 |

| 25 | Tennessee | $10,720 |

| 26 | Oregon | $10,714 |

| 27 | North Carolina | $10,672 |

| 28 | Oklahoma | $10,667 |

| 29 | Alabama | $10,659 |

| 30 | New Mexico | $10,271 |

| 31 | Wyoming | $10,242 |

| 32 | Pennsylvania | $10,125 |

| 33 | Montana | $10,085 |

| 34 | Missouri | $9,981 |

| 35 | Mississippi | $9,917 |

| 36 | Arkansas | $9,805 |

| 37 | Kansas | $9,762 |

| 38 | Vermont | $9,756 |

| 39 | Michigan | $9,734 |

| 40 | Minnesota | $9,703 |

| 41 | Maine | $9,615 |

| 42 | South Dakota | $9,483 |

| 43 | Nebraska | $9,369 |

| 44 | Ohio | $9,352 |

| 45 | Indiana | $9,324 |

| 46 | West Virginia | $9,212 |

| 47 | North Dakota | $9,132 |

| 48 | Kentucky | $9,124 |

| 49 | Iowa | $8,480 |

| 50 | Wisconsin | $8,424 |

Sun Belt and Coastal States Struggle

Sun Belt states like Texas ($12,786), Georgia ($12,819), and Florida ($12,624) rank high on the list, likely driven by growing populations, inflation pressures, and lifestyle spending. Coastal states such as New Jersey, Maryland, and Connecticut also feature above-average debt loads, reflecting both high living costs and urban financial behaviors.

Midwestern States Carry the Least Debt

At the other end of the spectrum, Midwestern and Plains states carry far less credit card debt. Iowa ($8,480), Wisconsin ($8,424), and the Dakotas all fall well below the national average. These states benefit from lower living costs and more conservative financial habits.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Mapped: Median Salary by U.S. State on Voronoi, the new app from Visual Capitalist.