Bill Blain: "We’ve Heard JPM Traders Bragging In The Pub How Much They’ve Made From Bitcoin"

Submitted by Bill Blain of Mint Partners

Blain’s Morning Porridge – September 20th 2017

“New Car, caviar, four star daydream, think I’ll buy me a football team….”

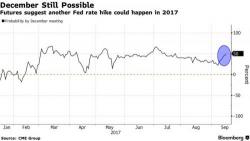

Will they? Won’t they? I’m not talking about Donald’s playground bluster about nuking North Korea back to the 1950s. Shocking and intemperate. Yes. But, plays to his audience.