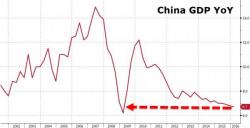

Futures Fade As Chinese "Good News Is Bad News" For Fed, Oil Drops As Doha Concerns Emerge

Good news is still bad news after all.

After last night's China 6.7% GDP print which while the lowest since Q1 2009, was in line with expectations, coupled with beats in IP, Fixed Asset Investment and Retail Sales (on the back of $1 trillion in total financing in Q1)...