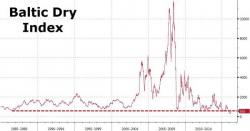

Iron Ore, Rebar Crash Into Bear Market, Baltic Dry Dead-Cat-Bounce Dies

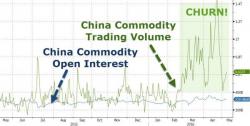

Real demand for steel in China dropped at least 7% in April from the year before, according to Citigroup’s Tracy Liao estimates, so it should not be a total surprise that the frenzied speculative buying in Iron Ore, Rebar, and various other industrial metals in China has crashed back to reality as volumes plunge, dragging The Baltic Dry Freight Index with it as yet another government-manipulated 'signal' collapses into a miasma of malinvestment and unintended consequences.