![]()

See this visualization first on the Voronoi app.

Use This Visualization

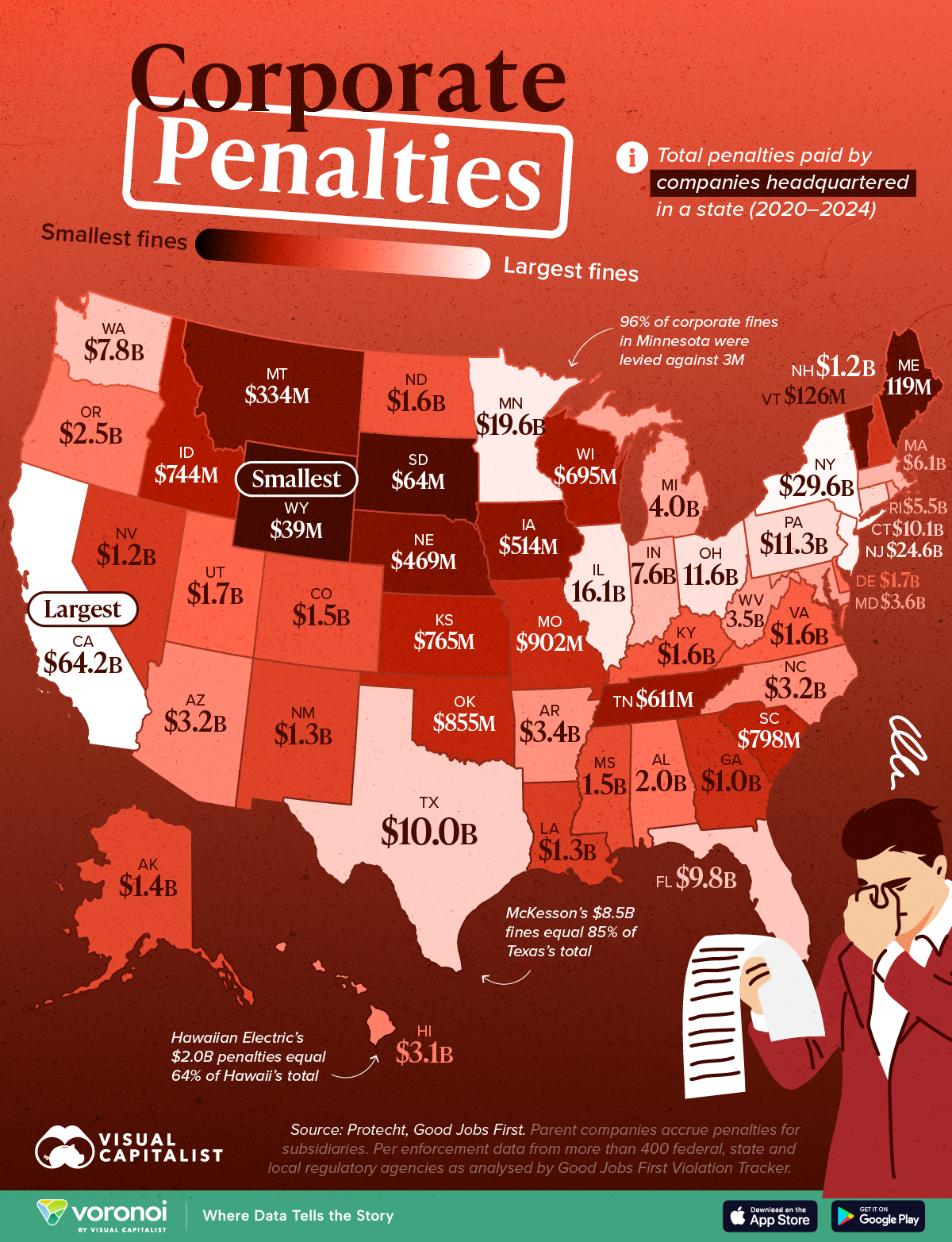

Corporate Penalties Levied in Each U.S. State (2020–2024)

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- California-based companies accrued $64.2 billion in fines, the most of any state between 2020 and 2024.

- The total reflects multiple blockbuster penalties: PG&E ($16.1 billion) for wildfire liabilities, Wells Fargo ($8.87 billion) for banking misconduct, plus large tech privacy and safety fines for Meta ($2.38 billion) and Alphabet ($1.80 billion).

Corporate missteps (or obvious misconduct) can be expensive, and those penalties are not spread evenly across America.

The map visualizes where $272 billion in company fines landed from 2020 through 2024, assigned to each state by the companies headquartered in them.

The data for this visualization is sourced from Protecht and Good Jobs First’s Violation Tracker.

It captures federal and state enforcement actions settled during the period, and includes non-American companies attracting U.S. fines.

Ranked: Fines Paid by Companies in Each State (2020–2024)

California tops the list with $64.2 billion in company fines, more than double runner-up New York’s $29.6 billion.

| Rank | State | State Code | Total Fines Accrued (2020–2024) |

|---|---|---|---|

| 1 | California | CA | $64.2B |

| 2 | New York | NY | $29.6B |

| 3 | New Jersey | NJ | $24.6B |

| 4 | Minnesota | MN | $19.6B |

| 5 | Illinois | IL | $16.1B |

| 6 | Ohio | OH | $11.6B |

| 7 | Pennsylvania | PA | $11.3B |

| 8 | Connecticut | CT | $10.1B |

| 9 | Texas | TX | $10.0B |

| 10 | Florida | FL | $9.8B |

| 11 | Washington | WA | $7.8B |

| 12 | Indiana | IN | $7.6B |

| 13 | Massachusetts | MA | $6.1B |

| 14 | Rhode Island | RI | $5.5B |

| 15 | Michigan | MI | $4.0B |

| 16 | Maryland | MD | $3.6B |

| 17 | West Virginia | WV | $3.5B |

| 18 | Arkansas | AR | $3.4B |

| 19 | North Carolina | NC | $3.2B |

| 20 | Arizona | AZ | $3.2B |

| 21 | Hawaii | HI | $3.1B |

| 22 | Oregon | OR | $2.5B |

| 23 | Alabama | AL | $2.0B |

| 24 | Delaware | DE | $1.7B |

| 25 | Utah | UT | $1.7B |

| 26 | Virginia | VA | $1.6B |

| 27 | Kentucky | KY | $1.6B |

| 28 | North Dakota | ND | $1.6B |

| 29 | Colorado | CO | $1.5B |

| 30 | Mississippi | MS | $1.5B |

| 31 | Alaska | AK | $1.4B |

| 32 | New Mexico | NM | $1.3B |

| 33 | Louisiana | LA | $1.3B |

| 34 | Nevada | NV | $1.2B |

| 35 | New Hampshire | NH | $1.2B |

| 36 | Georgia | GA | $1.0B |

| 37 | Missouri | MO | $902M |

| 38 | Oklahoma | OK | $855M |

| 39 | South Carolina | SC | $798M |

| 40 | Kansas | KS | $765M |

| 41 | Idaho | ID | $744M |

| 42 | Wisconsin | WI | $695M |

| 43 | Tennessee | TN | $611M |

| 44 | Iowa | IA | $514M |

| 45 | Nebraska | NE | $469M |

| 46 | Montana | MT | $334M |

| 47 | Vermont | VT | $126M |

| 48 | Maine | ME | $119M |

| 49 | South Dakota | SD | $64M |

| 50 | Wyoming | WY | $39M |

PG&E’s wildfire liabilities ($16.1 billion in total) outsize the collected fines of companies in all but five states.

New York’s tally is driven by Wall Street misconduct, including multibillion-dollar settlements with JPMorgan Chase and Deutsche Bank linked to money-laundering and mortgage-backed securities.

Meanwhile, 70% of New Jersey’s listed figure ($24.6 billion) is from Johnson & Johnson’s $18 billion in fines in the same period (for their role in the opioid crisis.)

Together, companies in these three coastal giants account for about 40% of all penalties issued nationwide.

Financial Services & Pharma Giants Attract Fines

Regulatory pressure tends to cluster where dominant industries are headquartered.

For example, financial services fines concentrated in New York and North Carolina, while energy and utility penalties rack up in Texas, Ohio, and Illinois.

Minnesota’s surprising fourth-place finish ($19.6 billion) traces mainly to 3M’s $10.3 billion PFAS contamination settlement, the largest clean-water payout in U.S. history.

Meanwhile, California’s tech hub status explains the multibillion-dollar privacy rulings against Meta and Alphabet.

Small States Have Smaller Corporate Penalties

At the other end of the spectrum, sparsely populated states saw comparatively light penalties accrued.

Wyoming companies incurred just $39 million over five years, and South Dakota only $64 million.

Limited corporate footprints—and fewer Fortune 500 headquarters—lead to fewer blockbuster fines.

Still, even in low-population regions, single cases can swing totals.

For example, Vermont’s $126 million figure largely reflects a single opioid settlement against Purdue Pharma affiliates.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Most-Fined Companies by the U.S. Government (2020–2024) on Voronoi, the new app from Visual Capitalist.