Global Stocks Rise, S&P Futures Hit New Record High Despite US Market Closure

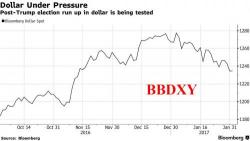

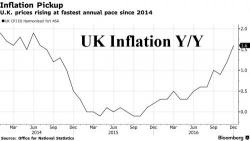

Despite US markets being closed in observance of Washington's birthday, S&P futures spiked during overnight trading, reaching new all time highs before fading some of the gains. Both Asian and European markets traded modestly higher after paring early gains. The U.S. dollar traded in a tight range ahead of a busy week for Federal Reserve events, while the pound rallied the most in more than two weeks ahead of a House of Lords Brexit debate, while South Africa’s rand fell on political turmoil. Oil advanced for a third day and spot gold rose for the fourth session in five.