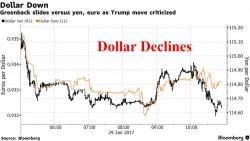

Global Stocks, Futures Slide On US Protectionism Worries Following Trump Travel Chaos

European, Asian stocks and S&P futures all drop after traders were left with a sour taste from the potential fallout of Donald Trump’s order halting some immigration and ahead of central bank decisions from the U.S. and Japan. Markets in Hong Kong, China, Malaysia, Korea, Singapore, Taiwan and Vietnam are all shut due to the Lunar New Year public holiday, leading to a quiet Asian session. Oil rebounded after sliding as much as 0.7%. Gold was unable to hold its overnight gains and has dipped into the red to $1,190 after rising just shy of $1,200 in early trading.