Why The G7 May Be Hastening Helicopter Money

Authored by Scott Minerd, Global CIO, Guggenheim Investments,

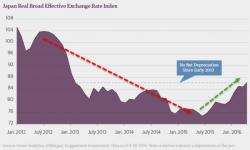

The G7 countries’ finance ministers recently ended their two-day meeting in Sendai, Japan, without an agreement on any economic policy issues, including those surrounding the recent sharp appreciation of the yen. The unwillingness of policymakers to address Japan's fervent appeals for exchange rate intervention may inadvertently hasten the implementation of helicopter money by Japan and other industrialized nations.