GPIF Is About To Bite Back

Authored by Kevin Muir via The Macro Tourist blog,

A few years ago, the Japanese government made an announcement that went unnoticed by many market pundits.

Authored by Kevin Muir via The Macro Tourist blog,

A few years ago, the Japanese government made an announcement that went unnoticed by many market pundits.

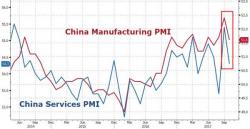

US equity futures have hit a new records, helped by surging Asian and European stocks which have all started November on a euphoric note. Surging commodity prices, optimism about tax reform and hope for a new dovish Fed chair all combined to drive global stock markets to record highs on Wednesday, with the MSCI’s world stock index climbing 0.3% to a fresh all time high. Mining stocks lead gains as nickel and other industrial metals soar.

Yesterday's sharp Chinese selloff is now a distant memory after the BTFDers emerged, and this morning U.S. equity futures are once again levitating as the FOMC begins its two-day policy meeting, following an uneventful BOJ announcement on Tuesday morning which left all QE parameters unchanged. Asian stocks traded mixed steady while European shares climb.

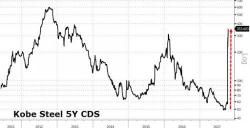

Last week, the simmering scandal involving Japan's third largest steel producer exploded, when following reports that Kobe Steel had falsified data about the quality of its steel, aluminum, copper, iron powder and other products it sold to customers across virtually every single industry, Japan's Nikkei also reported that some Kobe Steel plants in Japan had been falsifying product quality data for decades, well beyond the roughly 10-year time frame given by the lying steelmaker.

Whereas several years ago, forecasting that central banks would unleash wars, bloodshed and social conflict was considered so preposterous, it was relegated to the domain of fringe, tinfoil hat blogs, it has gradually been "normalized" as even the mainstream realized just how clueless the world's central planner truly are, and this scandalous topic ghas since migrated to the permitted list of items for discussion by respected, establishment institutions including banks and wealth managers, such as the UK's Clarmond Wealth.