![]()

See this visualization first on the Voronoi app.

Use This Visualization

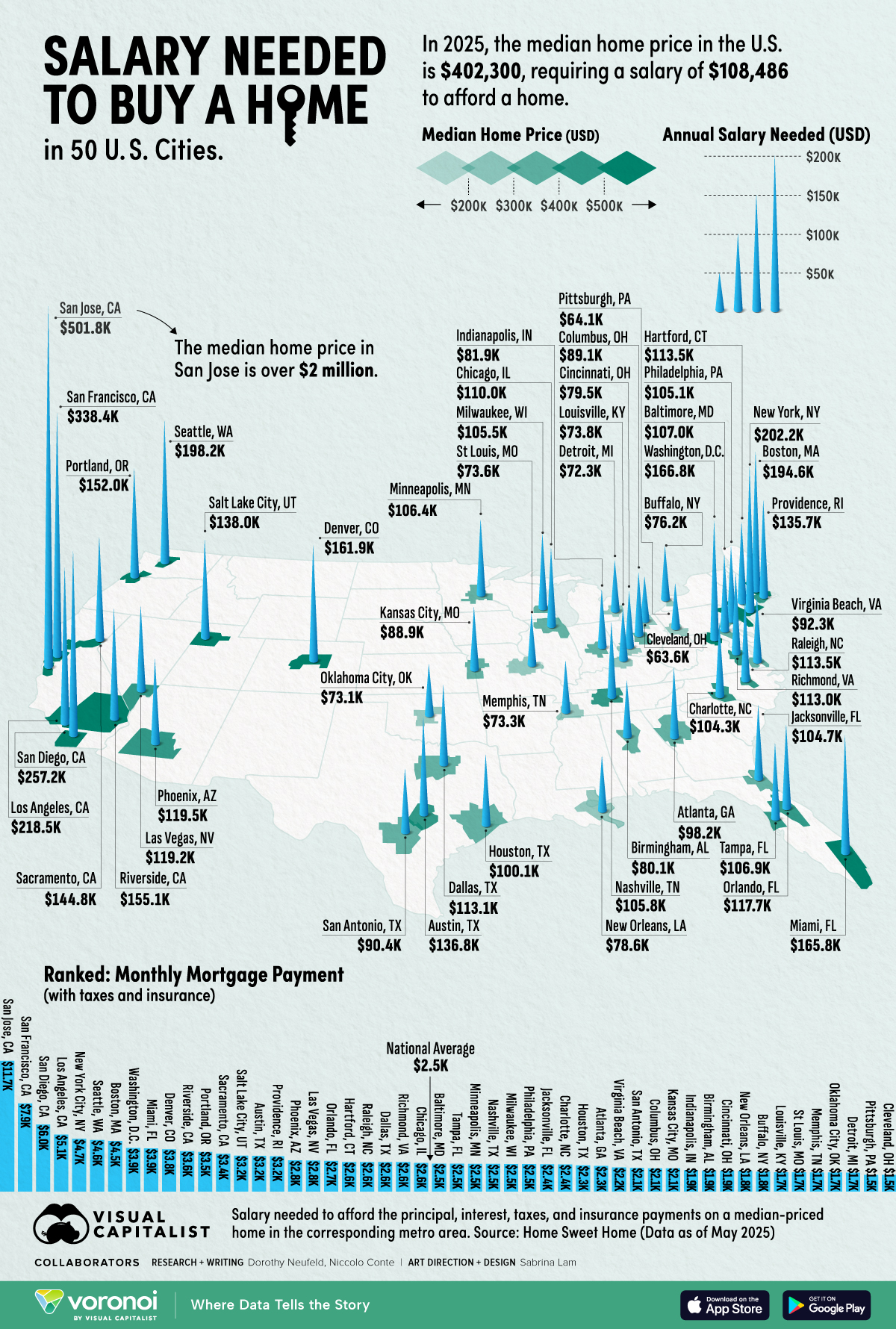

The Salary Needed to Buy a Home in 50 U.S. Cities in 2025

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Americans need to make $108,486 in income to afford a median-priced home in 2025.

- Buying a home in San Jose requires an eye-watering $501,760 salary, where the median price is over $2 million—up from $1.8 million in May 2024.

- By contrast, a salary of $63,611 is needed to afford a home in Cleveland, the lowest across 50 cities analyzed by Home Sweet Home.

Since 2017, the salary needed to buy a home in America has more than doubled.

Fueled by rising unaffordability and high mortgage rates, home buyers need to shell out $2,500 on average for monthly payments. Meanwhile, this soars past $5,000 in coastal cities like San Francisco, Los Angeles, and San Diego.

This graphic shows the salary you need to afford a home in 50 U.S. cities, based on data from Home Sweet Home.

What is the Salary Needed to Buy a Home in 2025?

Here is the income it takes to afford a median-priced home in 2025 across major cities:

Note: These calculations determine the salary needed to afford the principal, interest, taxes, and insurance payments on a median-priced home in the corresponding metro area as of Q1 2025. Figures reflect homes with a 30-year fixed-rate mortgage of 6.83% and a 20% down payment.

| Metro Area | Salary Needed | Median Home Price | Monthly Payment |

|---|---|---|---|

| San Jose | $501,760 | $2,020,000 | $11,708 |

| San Francisco | $338,427 | $1,320,000 | $7,897 |

| San Diego | $257,190 | $1,036,500 | $6,001 |

| Los Angeles | $218,483 | $862,600 | $5,098 |

| New York City | $202,150 | $725,300 | $4,717 |

| Seattle | $198,233 | $772,900 | $4,625 |

| Boston | $194,593 | $734,000 | $4,541 |

| Washington, D.C. | $166,814 | $630,900 | $3,892 |

| Miami | $165,818 | $643,900 | $3,869 |

| Denver | $161,935 | $647,800 | $3,778 |

| Riverside/San Bernardino | $155,109 | $609,200 | $3,619 |

| Portland | $151,963 | $591,200 | $3,546 |

| Sacramento | $144,791 | $550,000 | $3,378 |

| Salt Lake City | $138,012 | $556,500 | $3,220 |

| Austin | $136,845 | $465,100 | $3,193 |

| Providence | $135,721 | $492,700 | $3,167 |

| Phoenix | $119,546 | $487,900 | $2,789 |

| Las Vegas | $119,242 | $486,400 | $2,782 |

| Orlando | $117,731 | $445,000 | $2,747 |

| Hartford | $113,491 | $378,300 | $2,648 |

| Raleigh | $113,466 | $443,900 | $2,648 |

| Dallas | $113,069 | $377,900 | $2,638 |

| Richmond | $112,951 | $446,300 | $2,636 |

| Chicago | $110,038 | $371,500 | $2,568 |

| National | $108,486 | $402,300 | $2,531 |

| Baltimore | $106,969 | $393,000 | $2,496 |

| Tampa | $106,903 | $400,000 | $2,494 |

| Minneapolis | $106,442 | $388,100 | $2,484 |

| Nashville | $105,831 | $417,600 | $2,469 |

| Milwaukee | $105,477 | $388,100 | $2,461 |

| Philadelphia | $105,118 | $363,000 | $2,453 |

| Jacksonville | $104,718 | $390,000 | $2,443 |

| Charlotte | $104,324 | $411,200 | $2,434 |

| Houston | $100,142 | $337,400 | $2,337 |

| Atlanta | $98,232 | $369,400 | $2,292 |

| Virginia Beach | $92,269 | $350,200 | $2,153 |

| San Antonio | $90,393 | $300,000 | $2,109 |

| Columbus | $89,131 | $321,800 | $2,080 |

| Kansas City | $88,913 | $328,700 | $2,075 |

| Indianapolis | $81,918 | $316,200 | $1,911 |

| Birmingham | $80,084 | $312,800 | $1,869 |

| Cincinnati | $79,540 | $293,900 | $1,856 |

| New Orleans | $78,572 | $291,000 | $1,833 |

| Buffalo | $76,156 | $245,900 | $1,777 |

| Louisville | $73,844 | $278,100 | $1,723 |

| St Louis | $73,581 | $262,100 | $1,717 |

| Memphis | $73,302 | $276,100 | $1,710 |

| Oklahoma City | $73,052 | $258,800 | $1,705 |

| Detroit | $72,296 | $254,200 | $1,687 |

| Pittsburgh | $64,071 | $225,400 | $1,495 |

| Cleveland | $63,611 | $213,200 | $1,484 |

Known for its competitive housing market, San Jose ranks at the top, where buyers need to earn $501,760 to buy a home.

Driven by limited supply and high demand from tech workers, a median-priced home is over $2 million. Notably, in April 2025, 71% of listings sold above their asking price. Sitting in the heart of Silicon Valley, San Jose is home to more than 6,600 tech companies.

Similarly, the AI boom is driving overbidding and sales volumes in San Francisco. In the first quarter of 2024, the median home price stood at $1.3 million, requiring a salary of $338,427 to afford a home—more than three times the national average.

Meanwhile, Miami falls in ninth place as home prices have surged given migration inflows spurred by the pandemic. Today, buying a home in Miami requires a salary of $165,818. For perspective, this jumped from about $70,000 since Q1 2017.

By contrast, Cleveland, Pittsburgh, and Detroit offer the greatest affordability, where homes cost at least a third less than the national average and require under $73,000 in income to purchase.

Learn More on the Voronoi App ![]()

To learn more about this topic from an affordability perspective, check out this graphic on the most affordable cities to buy a home.