Global Stocks Pull Back From All Time Highs On Poor Chinese Data; All Eyes On CPI

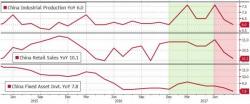

Global stocks backed off from all time highs, and S&P futures are unchanged ahead of the much anticipated US CPI report, which is expected to break a streak of five consecutive misses, while eyeing disappointing overnight Chinese economic data which missed across the board. European stocks and Asian markets were also modestly in the red, with the relentless global rally to new daily record highs taking a breather amid some concerns China's economy is rolling over, which weighed on commodities including base metals, which in turned dragged down mining stocks.