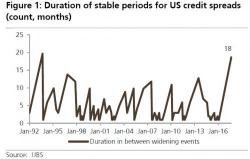

What Catalyst Could Trigger A Credit Risk-Off Event? Here's The UBS Answer

"What is THE catalyst?"

As all traders know, and as UBS repeats this morning in a new report by credit strategist Matthew Mish, one if not the mostly commonly asked questions is "what events could disrupt global corporate credit markets heading into year-end and early 2018."