Where Negative Interest Rates Will Lead Us

Submitted by Patrick Barron via The Mises Institute,

Submitted by Patrick Barron via The Mises Institute,

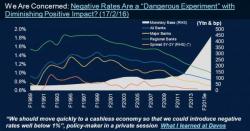

Two weeks ago, on one of the slides in a Morgan Stanley presentation, we found something which we thought was quite disturbing. According to the bank's head of EMEA research Huw van Steenis, while in Davos, he sat "next to someone in policy circles who argued that we should move quickly to a cashless economy so that we could introduce negative rates well below 1% – as they were concerned that Larry Summers' secular stagnation was indeed playing out and we would be stuck with negative rates for a decade in Europe.

Submitted by Michael Snyder via The Economic Collapse blog,

When a leading nominee for President gets something exactly right, we should applaud them for it. In this case, Donald Trump’s call to audit the Federal Reserve is dead on correct. Most Americans don’t realize this, but the Federal Reserve has far more power over the economy than anyone else does – including Barack Obama.

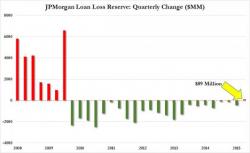

Back on January 14, we noted that JPMorgan did something they haven’t done in 22 quarters: the bank increased its loan loss provisions.

The "reserve build of ~$100mm [is] driven by $60mm in Oil & Gas and $26mm in Metals & Mining within the commercial banking group,” the bank said.

When the Fed unveiled its reverse repo program several years ago, it was meant to be a means for the Federal Reserve to soak up excess liquidity from domestic financial institutions when the Fed eventually proceeded to hike interest rates, as it did in mid-December.