Why The Fed Will Never Succeed

Submitted by Alasdair Macleod via GoldMoney.com,

The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates.

Submitted by Alasdair Macleod via GoldMoney.com,

The Fed will never succeed in its attempt to manage inflation and unemployment by varying interest rates.

Submitted by Frank Shostak via The Mises Institute,

According to the Austrian business cycle theory (ABCT) the artificial lowering of interest rates by the central bank leads to a misallocation of resources because businesses undertake various capital projects that — prior to the lowering of interest rates —weren’t considered as viable. This misallocation of resources is commonly described as an economic boom.

Submitted by Charles Hugh-Smith via OfTwoMinds blog,

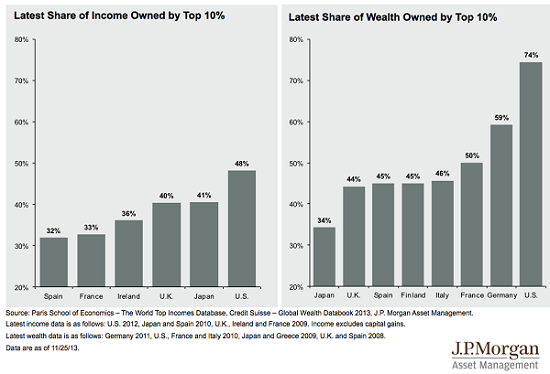

The injustice of central-bank enforced neofeudalism cannot be suppressed like interest rates.

When it comes to central bankers gone “full Krugman” (as it were) you’d be hard pressed to find someone more Keynesian crazy than BoJ governor Haruhiko Kuroda.

Kuroda - who earlier this year likened himself to Peter Pan on the way to explaining that it’s possible to conduct unconventional monetary policy in perpetuity as long as market participants continue to “believe” - has not only managed to suck up the entirety of gross JGB issuance, he’s also succeeded in cornering the market for Japanese ETFs.