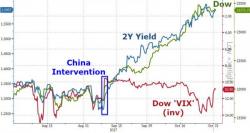

Dow 25,000 In Sight As Tax Cuts Are "Priced In" One Last Time

Dow futures are up some 80 points this morning after early on Wednesday morning the Senate passed the Tax Reform bill in a party-line vote, and is now set to become law after a follow-up vote in the House and Trump's signature some time on Wednesday afternoon. The good news is that the biggest political drama of 2017 will then be over. The bad news is that once the bill becomes law, the market will no longer be able to "price it in" every single day as it has for the past year.