Global Stocks Rise On Strong Economic Data, Dollar Set To End Streak Of Monthly Declines

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

E-mini futures are fractionally lower this morning (0.08%) after Apple's surge helped the DJIA climb above 22,000 for the first time on Wednesday; Global shares declined for the first time in 4 days pressured by tech stocks: Asian shares fell, while Europe pared opening losses to trade unchanged.

The levitation continues with S&P futures pointing to - what else - another higher open while European stocks swung between gains and losses on the busiest earnings days of the year (85 of the Stoxx 600 report) which has seen European pharma giant AstraZeneca plunge 15%, the most on record, after its flagship lung cancer trial Mystic failed to show benefits, while Deutsche Bank slumped 4% on a 12% plunge in FICC revenue.

S&P futures were fractionally higher (+0.1% to 2,476) with all eyes on the Fed's rate decision as investors await another earnings deluge from companies including Facebook, Coca-Cola and Boeing. Asian and European shares were also higher, prompted by momentum from the latest US record high; the Dollar rebound continued while oil rose above $48 as copper hit a two year high.

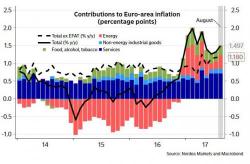

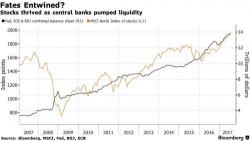

The relentless risk levitation continued overnight, as global shares extended their stretch of consecutive record highs on Thursday for a 10th day after a cautious BOJ lifted Asian stocks to a decade high with a dovish announcement that offered no surprises, while pushing back Kuroda's 2% inflation target to 2020, the 6th consecutive delay. With all eyes on the ECB in just over an hour, US equity futures are in the green, following solid gains around the globe. European stocks extended their biggest gain in a week while Asian equities maintained their rally.