How Debt-Asset Bubbles Implode: The Supernova Model Of Financial Collapse

Authored by Charles Hugh Smith via OfTwoMinds blog,

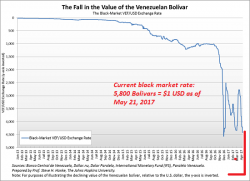

When debt-asset bubbles expand at rates far above the expansion of earnings and real-world productive wealth, their collapse is inevitable. The Supernova model of financial collapse is one way to understand this.

As I noted yesterday in Will the Crazy Global Debt Bubble Ever End?, I've used the Supernova analogy for years, but didn't properly explain why it illuminates the dynamics of financial bubbles imploding.