What David Tepper Bought (Besides SNAP) And Sold In Q1: The Full Breakdown

Yes, David Tepper's Appaloosa bought Snapchat in Q1. No, it wasn't a material amount: he only bought a 100,000 share flier in the name, or under $2.3 million.

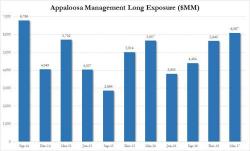

What is most notable about Tapper's Q1 holdings (aside from the SNAP non-story, of course) is that he took his total long stake to just under $6.1 billion as of March 31, up from $5.6 billion at the end of 2016, and the highest net long exposure since September 2014.

Here is a breakdown of the key position changes for Tepper as of March 31: