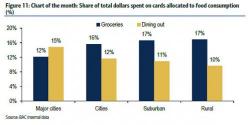

Home Capital Depositors Have Withdrawn 94% Of Funds In Past 6 Weeks

According to its latest daily update, Canada's biggest non-bank lender Home Capital Group showed the rate of withdrawals by depositors was slowing, one day after the company raised doubts about its ability to continue as a going concern, albeit for a simple reason: there are almost none left. In other words, over the past six weeks, depositors have withdrawn 94% of funds from Home Capital's high-interest savings accounts since March 28, when the company terminated the employment of former Chief Executive Martin Reid.