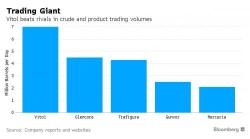

"There’s No Growth": World's Largest Oil Trader Has A Stunning Warning For OPEC

When it comes to the oil market, the narrative over the past year, ever since OPEC's first aborted meeting last April, has been just one: limit crude supply in hopes of rebelancing the oil market, reducing excess inventories, in the process sending the price of oil higher. However, echoing what we have warned for many months, overnight the world’s biggest independent oil trader said OPEC's efforts could be in vain because the oil producing cartel is seeking to control the wrong thing: it's not a matter of supply, but global demand which is simply not there.