How Uber Hurts Hertz

Authored by Wolf Richter via WolfStreet.com,

Undercutting competition by burning unlimited amounts of investor cash is part of the business model.

Authored by Wolf Richter via WolfStreet.com,

Undercutting competition by burning unlimited amounts of investor cash is part of the business model.

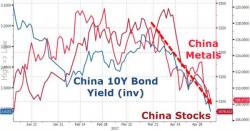

While China 'ripples' are top of mind for professional investors currently (though you would not know it from the constant AAPL, AMZN, NFLX chatter on mainstream business media), RBC's head of cross-asset strategy Charlie McElligott takes a step back to look at the overall picture once again.

China's deleveraging is hitting everything - how long before it 'ripples' across the Pacific? Or will the PBOC fold and inject liquidity?

Who could have seen this coming?

We have noted the stark divergence between still robust expectations/ surveys/ confidence (soft data) and relatively weak final sales/ production/ spending (hard data) numerous times in the past few months.

But note how the recent collapse in “soft” upside surprises has totally eliminated this gap.

This is relatively straight forward to explain in context. Both the underlying macro data change and consensus indices for soft data were running at post GFC highs at the end of March/early April.

Back in January, Harvard's Endowment stunned the investing world when it announced that the investing vehicle which manages $36 billion in assets, would undergo a "radical overhaul" in the way the world’s wealthiest school invests its money by outsourcing management of most of its assets and lay off roughly half the staff in the process. As the WSJ reported at the time, about half of the 230 employees at Harvard Management Company would depart as part of a sweeping change by the university’s new endowment chief, N.P. “Narv” Narvekar.

Speaking at today's Ira Sohn conference, Pershing Square’s Bill Ackman reiterated his Howard Hughes long recommendation - a name he has been involved with for years - citing its strong management and desirable locations as reasons why it should become more valuable over time. According to Reuters data, Ackman's $11 billion Pershing Square Capital Management owns 8.85% of Howard Hughes and ranks as its biggest shareholder. Oh, and Ackman serves on the company's board so no conflict there.