A Delighted Wall Street Reacts To The French Election

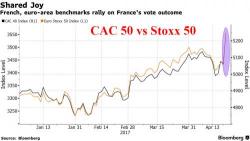

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

With European stocks on fire, and US futures moving fast to recoup recent all time highs, it is no surprise that Wall Street is feeling particularly bullish this morning.

Risk is definitely on this morning as European shares soar, led by French stocks and a new record high in Germany's Dax, after a "French relief rally" in which the first round of the country’s presidential elections prompted investors to bet that establishment candidate Emmanuel Macron will win a runoff vote next month, and who is seen as a 61% to 39% favorite to defeat Le Pen according to the latest just released Opinionway poll.

For those who may have missed yesterday's events, here is a quick recap from DB:

Authored by Mike Shedlock via MishTalk.com,

Project Syndicate writer, Hans-Werner Sinn, explains why the ECB’s asset purchases and Target2 imbalances constitute “Europe’s Secret Bailout”.

Under the ECB’s QE program, which started in March 2015, eurozone members’ central banks buy private market securities for €1.74 trillion ($1.84 trillion), with more than €1.4 trillion to be used to purchase their own countries’ government debt.

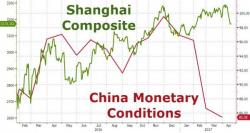

Despite a liquidity injection and the rest of the world in 'risk-on' mode over the French election results, Chinese markets are tumbling...

On Friday, we asked "Is China Trying To (Slowly) Burst Another Stock Market Bubble?" as Chinese monetray conditions were tightening dramatically...

And, as Bloomberg reports, it seems the catalyst is further crackdowns on shadow-banking.

The key economic releases this week are the durable goods report on Thursday and Q1 GDP on Friday. It iweek is the busiest week of earnings season, with 40% of S&P 500 equity cap reporting. In addition, there are a few scheduled speaking engagements by Fed officials this week.