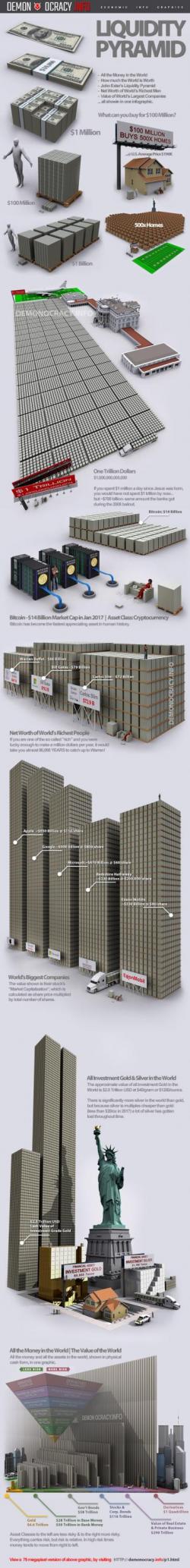

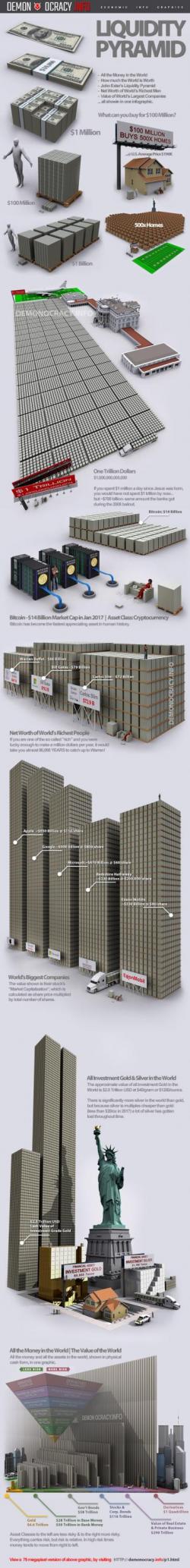

Visualizing Exter's Liquidity Pyramid (In Physical $100 Bills)

All the money and all the assets in the world, shown in physical cash form, in one graphic.

(click image for huge legible version)

Source: Demonocracy

All the money and all the assets in the world, shown in physical cash form, in one graphic.

(click image for huge legible version)

Source: Demonocracy

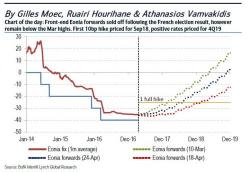

With the ECB set to announce its latest monetary policy decision in less than 12 hours, one can summarize in one word what the market expects: nothing. Sure, there are some nuances - the central bank may wax philosophical about Europe's better growth prospects, and maybe even set the stage for a small signal as early as June about an eventual reduction of stimulus, but don't count on it. After all, there is a reason - or rather two - why markets are where they are today, and it has to do with central banks creating a record $1 trillion in new money out of thin air.

Two weeks ago, when JPMorgan launched Q1 earnings season, we noted that while the results were generally good, one red flag emerged: the company's credit card charge offs rose to just shy of $1 billion, the highest in four years.

It wasn't just JPM: all other money-center banks reported similar trends, so we decided to look into it.

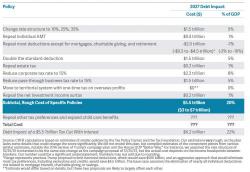

While today's "tremendously" vague one-page summary of Trump's tax plan had barely any detail - it did not even include the income ranges for the three personal income tax brackets - it did contain enough information for the CRFB to be able to score it, and calculate how much it would cost, or in other words assuming little or no offsetting revenues, this is how much additional debt it would add to the existing upward trajectory in US national debt.

By Paul Brodsky of Macro Allocation Inc.