Published

9 mins ago

on

July 3, 2025

| 11 views

-->

By

Julia Wendling

Article & Editing

- Alan Kennedy

Graphics & Design

- Athul Alexander

The following content is sponsored by Inigo Insurance

Ranking America’s Most Common Financial Crimes

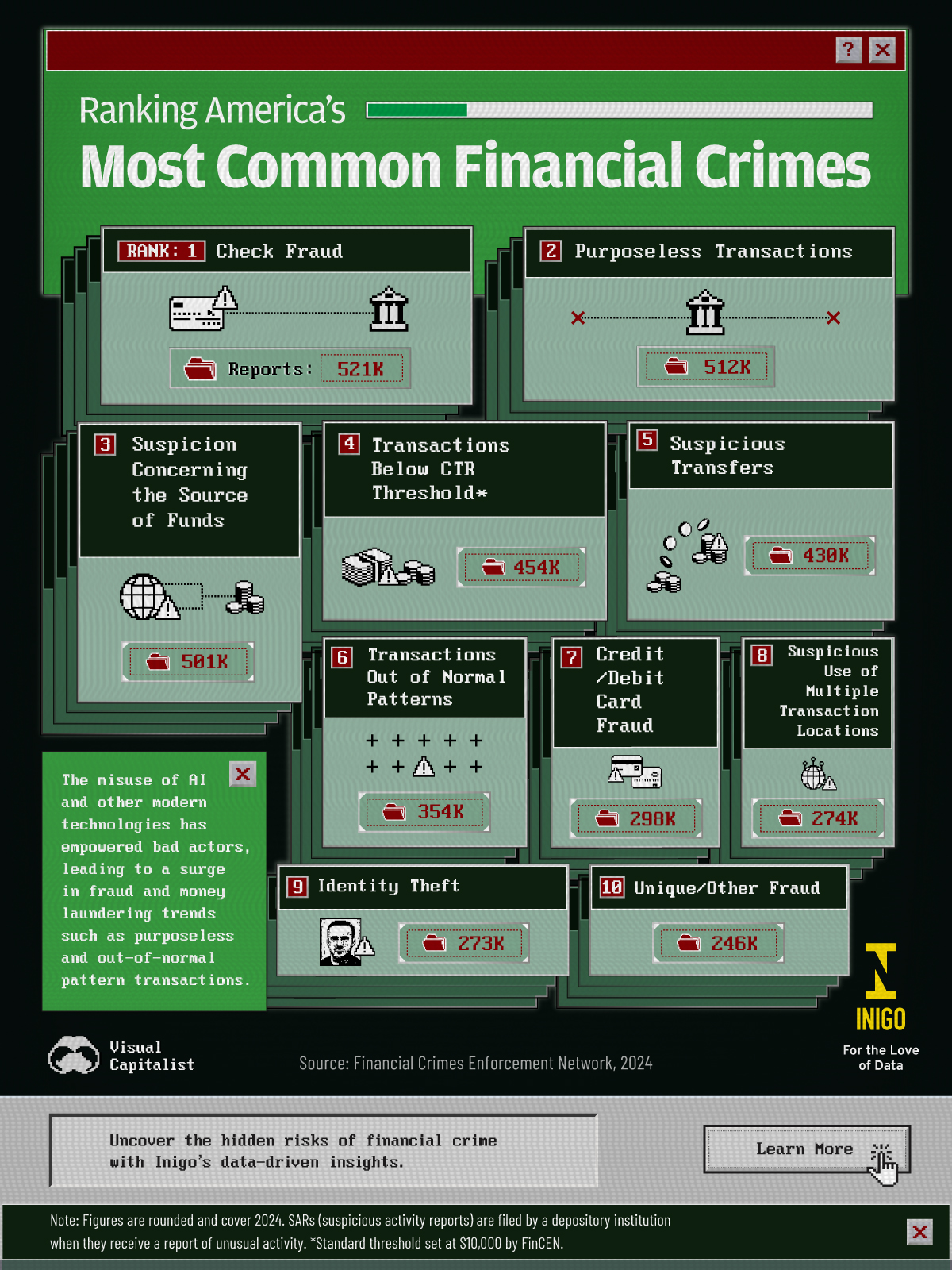

As technology and AI become more widespread, fraud and other suspicious activities are on the rise across America. But which types are the most common?

In partnership with Inigo Insurance, this graphic breaks down the most frequently reported financial crimes, using data from the Financial Crimes Enforcement Network.

Rising Wave of Fraud

Financial crime is on the rise, with no signs of slowing down. According to Kroll’s 2025 Financial Crime Report, 71% of respondents expect financial crime risks to grow even further throughout 2025. Even more worrying, fewer than a quarter believe their companies are adequately protected.

So, what’s fueling this surge in financial crime worldwide? Several factors are at play—from geopolitical tensions to fragile supply chains. But one of the biggest emerging threats is criminals’ growing use of AI, including deepfake images and videos. In fact, the misuse of AI and other modern technologies has given bad actors even more power, driving a rise in fraud and money laundering schemes, such as purposeless or out-of-pattern transactions.

The Top Financial Crimes in America

The three most common financial crimes are check fraud, purposeless transactions—meaning financial activities with no legitimate business or lawful purpose—and suspicious sources of funds. Each of these saw more than 500,000 monthly reports in 2024.

| Rank | Suspicious Activity | Count |

|---|---|---|

| 1 | Check Fraud | 521k |

| 2 | Transaction with No Apparent Economic/Business/Lawful Purpose | 512k |

| 3 | Suspicion Concerning the Source of Funds | 501k |

| 4 | Transaction(s) Below CTR Threshold | 454k |

| 5 | Suspicious EFT/Wire Transfers | 430k |

| 6 | Transaction Out of Pattern for Customer(s) | 354k |

| 7 | Credit/Debit Card Fraud | 298k |

| 8 | Suspicious Use of Multiple Transaction Locations | 274k |

| 9 | Identity Theft | 273k |

| 10 | Other Fraud | 246k |

Rounding out the top five are transactions that fall below the Currency Transaction Report (CTR) threshold (generally between $200 and $10,000) and suspicious transfers.

The rest of the list includes transactions outside normal patterns, credit and debit card fraud, suspicious use of multiple transaction locations, identity theft, and other unique types of fraud—together accounting for nearly 1.5 million reports.

Be Prepared

Financial crime poses a diverse range of risks. Defending against it requires data-driven expertise that reveals hidden dangers and protects our wealth protectors.

Visit Inigo for a data-driven view of risk.

You may also like

-

Economy23 hours ago

Tracking the $3.1 Trillion Financial Crime Pandemic

From money laundering to fraud, financial crime acts as a drain on the economy, totaling an incredible $3.1 trillion.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up