Plunging Used Car Prices Wreak Havoc On Rental Car Bondholders

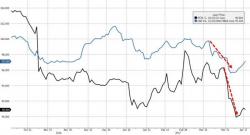

Once hedge fund darlings, almost no one is more perfectly aligned to get obliterated by falling used car prices than America's auto rental companies, Hertz and Avis. As Bloomberg notes today, on a combined basis, Hertz and Avis dump about 400,000 vehicles per year into the used car market and operate fleets that are multiple times larger.

And with used car prices plunging, bondholders are starting to get slightly anxious about the collateral impact of writing down billions of dollars worth of capital assets.