Weekend Reading: Washington, We Have A Problem

Authored by Lance Roberts via RealInvestmentAdvice.com,

Authored by Lance Roberts via RealInvestmentAdvice.com,

So Q1 is over and this happened...

And the message is clear...

Gold wins...

It's been an interesting quarter...

Bank of America's Michael Hartnett is back with another controversial note overnight, reminding readers that "it ain't a normal cycle" for one overarching reason: central banks.

Authored by Michael Snyder via The Economic Collapse blog,

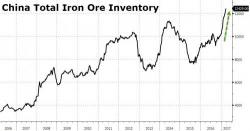

Previously we reported that iron ore prices - having almost doubled in the past year and launching a global reflationary wave - are on the verge of tumbling as the world becomes increasingly aware that China has a "13,000 Eiffel Tower" record inventory problem.

And while we previously discussed the immediate adverse implications for iron ore bulls, the conseqences for the global economy could be far more material.

Conveniently, in a note this morning, BMO's Mark Steel looked at the same issue, focusing on the big picture implications.