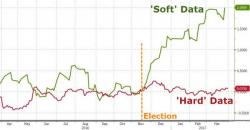

Right On Cue Atlanta Fed Cuts Q1 GDP Forecast After Poor Consumer Spending Report

Following today's disappointing consumer spending data, we forecast that a downward revision to the Atlanta Fed's most recent 1.0% Q1 GDP forecast was imminent...

Atlanta Fed to revise its Q1 GDP lower once more after Personal Consumption disappointment

— zerohedge (@zerohedge) March 31, 2017