What Is America Going To Look Like When Stock, Housing, And Even Used Car Prices All Crash?

Authored by Michael Snyder via The Economic Collapse blog,

Authored by Michael Snyder via The Economic Collapse blog,

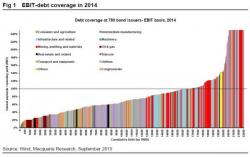

Back in October 2015, roughly around the bottom of the recent commodity cycle, we reported a stunning statistic: more than half of Chinese companies did not generate enough cash flow to even cover the interest on their cash flow, and as we concluded "it is safe to assume that up to two-third of Chinese commodity companies are now at imminent danger of default, as they can't even generate the cash to pay down the interest on their debt, let alone fund repayments."

Authored by Mark St.Cyr,

There’s an old truism people forget all too often. It has many variations and is attributed to even more, its core meaning goes something like this:

“If the government can give it to you, than it can also take it away.”

Dallas Mayor Mike Rawlings has finally reached his maximum willingness to throw taxpayer dollars at the Dallas Police and Fire Pension (DPFP) system and has pulled is support for a bill that, if it passes, will undoubtedly prove to be yet another futile effort to save the system from insolvency. Despite support for the original legislation introduced by Dan Flynn, chair of the pensions committee in the Texas House of Representatives, Rawlings apparently took issue with a last minute addition to the bill that would have taxpayers fund the pensions of "phantom employees" based on a t

In what may be one of the few sane policy recommendations to emerge out of Japan in years, Nobuyuki Nakahara, an adviser to Prime Minister Shinzo Abe and an influential former Bank of Japan board member said the BOJ should make a "clean break" from its current policy