Rig Count Continues To Threaten Oil Price Recovery, Saudis Cut Prices To Asia (Again)

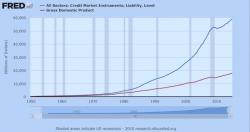

For the 11th week in a row, the number of US oil rigs rose (up 10 to 662 - the highest since September 2015). US Crude production continues to track the lagged rig count, pouring more cold water on OPEC's production cut party.

The rig count grows, tracking the lagged oil price in a self-defeating cycle...

And crude production appears to have plenty more room to run...

And don't forget, as Nick Cunningham detailed, there are thousands of drilled shale wells are sitting idle, unfracked and uncompleted.