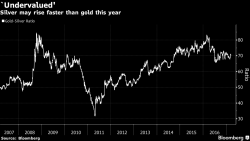

Silver 1/ 70th The Price of Gold – Silver Eagles Buying Jumps

Silver 1/ 70th The Price of Gold – Silver Eagles Buying Jumps

Silver 1/ 70th The Price of Gold – Silver Eagles Buying Jumps

Having returned from a brief hiatus, Richard Breslow, a former FX trader and fund manager who writes for Bloomberg, is back with some much needed warnings.

Maybe traders really do prefer to be kept in the dark. We clamor constantly for better communication and a detailed plan. But it’s difficult to look at where global markets are trading and conclude there’s any penalty for the utter lack of clarity. It seems that everyone has simply concluded that you have your priorities and I have mine: and John Nash had better be right.

European stocks are modestly in the green as gains in banks and oil companies offset declines in miners. Asian stocks and S&P futures rise with Emerging-market stocks extending their longest winning streak since August on the back of the 5th consecutive daily drop in the USD.

Authored by Nick Kamran via LettersFromNorway.com,

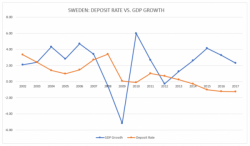

Sweden’s welfare state supposedly allows for success while providing a safety net for those unable to keep up with the market. In principle, it is an ideal state, achieving a utopian like state. However, Sweden’s touted economic success has come at the expense of the Krone (SEK) and long-term sustainability. Riksbank, the Swedish Central Bank, like their European contemporaries, have undertaken experimental policy, driving real and nominal interest rates below zero.

There has been no shortage of sellside reactions to last week's Fed rate hike, which have run the gamut from congratulatory as per BofA and Credit Suisse, to the outright critical, as we showed last week in a note from Goldman Sachs, RBC and SocGen, all of whom accused the Fed of either misleading the market, or soon being being forced to double down on its hawkish message as a result of the dramatic easing in financial conditions as a result of a rate hike.