EU Taxpayers Brace As Deepening Banking Crisis Means Euro-TARP Looms

Authored by Don Quijones via WolfStreet.com,

If the ECB scales back stimulus, banks face even greater risk of collapse. But now there’s a new solution

Authored by Don Quijones via WolfStreet.com,

If the ECB scales back stimulus, banks face even greater risk of collapse. But now there’s a new solution

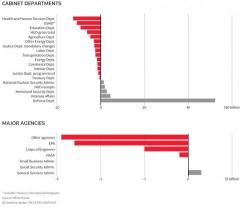

Appearing on Meet the Press earlier this morning with the always condescending, well at least if he's interviewing a Republican guest, Chuck Todd, the Director of the Office of Management and Budget, Mick Mulvaney, said there's no hope of achieving a balanced budget this year. Of course, that should hardly come as a surprise to almost anyone other than the suddenly fiscally conservative Chuck Todd.

Every week we talk about the supply and demand fundamentals. We were surprised to see an article about us this week. The writer thought that our technical analysis cannot see what’s going on in the market. We don’t want to fight with people, we prefer to focus on ideas. So let’s compare and contrast ordinary technical analysis with what Monetary Metals does.

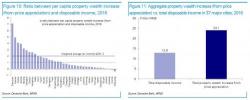

On Friday, we summarized research reports from Deutsche Bank and Bank of America, which came to the same conclusion: the fate of the global economic rebound may be in the hands of the Chinese housing bubble, which through price appreciation has unleashed wealth effect equivalent to twice the annual disposable income of China.

Two weeks after Deutsche Bank first announced it would raise €8 billion in capital as part of a comprehensive restructuring, the German lender on Sunday announced the terms of its upcoming massive dilution.