![]()

See this visualization first on the Voronoi app.

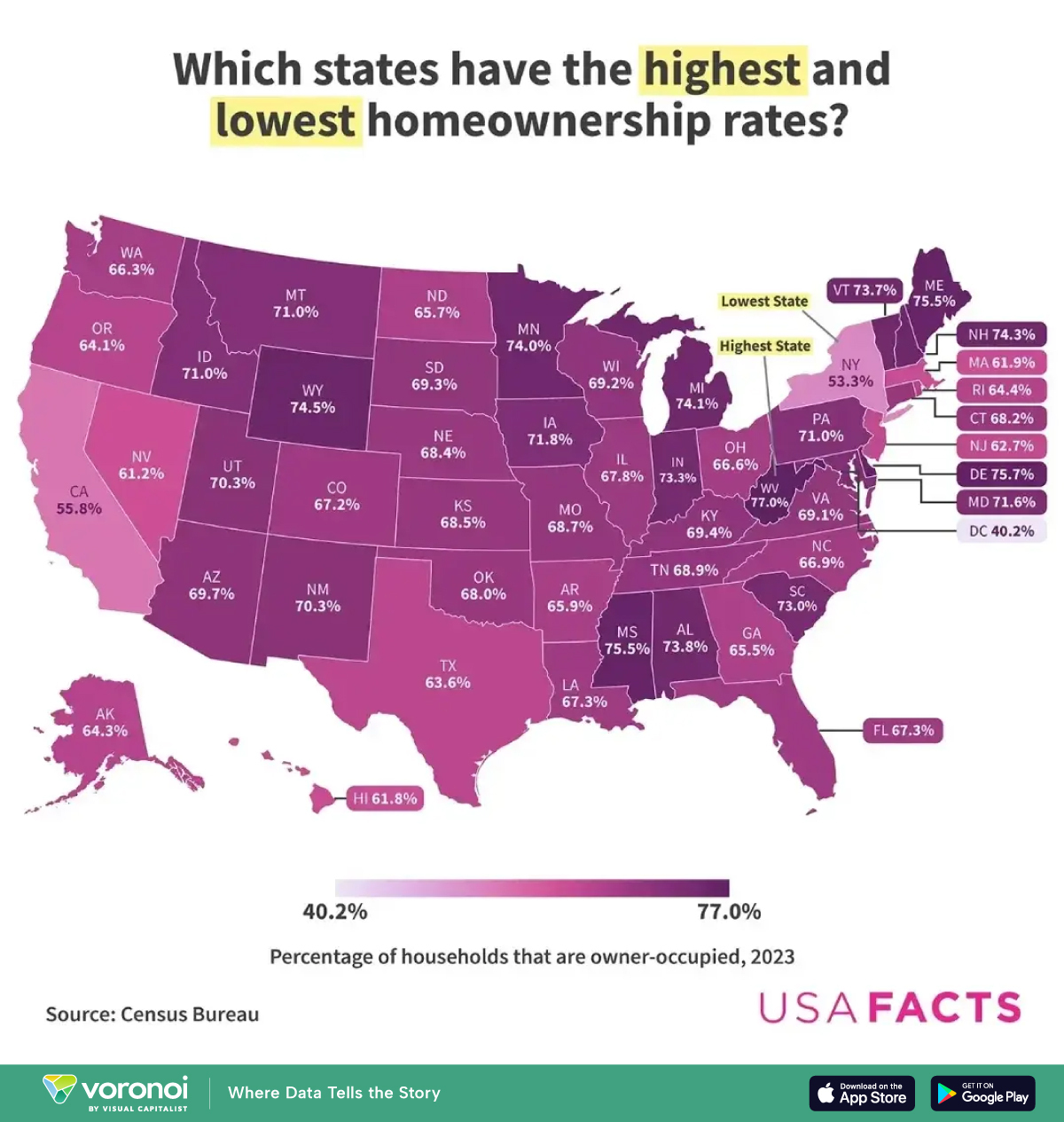

U.S. States By Home Ownership Rates

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

As of 2024, nearly two-thirds (65.7%) U.S. households owned their home, while the rest rented.

However, homeownership rates vary widely across states and between urban, suburban, and rural areas, reflecting differences in affordability, housing availability, and local economic conditions.

This map by USAFacts visualizes the share of households that are owner-occupied by state in 2023.

Data comes from the Census Bureau’s Housing Vacancies and Homeownership portion of the Current Population Survey.

Which State Has the Highest Home Ownership Rate?

Below, we show home ownership rates by state in 2023.

| State/Area | Share of households that are owner-occupied (2023) |

|---|---|

| West Virginia | 77.0% |

| Delaware | 75.7% |

| Mississippi | 75.5% |

| Maine | 75.5% |

| Wyoming | 74.5% |

| New Hampshire | 74.3% |

| Michigan | 74.1% |

| Minnesota | 74.0% |

| Alabama | 73.8% |

| Vermont | 73.7% |

| Indiana | 73.3% |

| South Carolina | 73.0% |

| Iowa | 71.8% |

| Maryland | 71.6% |

| Montana | 71.0% |

| Idaho | 71.0% |

| Pennsylvania | 71.0% |

| Utah | 70.3% |

| New Mexico | 70.3% |

| Arizona | 69.7% |

| South Dakota | 69.3% |

| Wisconsin | 69.2% |

| Virginia | 69.1% |

| Tennessee | 68.9% |

| Missouri | 68.7% |

| Kansas | 68.5% |

| Nebraska | 68.4% |

| Kentucky | 68.4% |

| Connecticut | 68.2% |

| Oklahoma | 68.0% |

| Illinois | 67.8% |

| Louisiana | 67.3% |

| Florida | 67.3% |

| Colorado | 67.2% |

| North Carolina | 66.9% |

| Ohio | 66.6% |

| Washington | 66.3% |

| Arkansas | 65.9% |

| North Dakota | 65.7% |

| Georgia | 65.5% |

| Rhode Island | 64.4% |

| Alaska | 64.3% |

| Oregon | 64.10% |

| Texas | 63.6% |

| New Jersey | 62.7% |

| Massachusetts | 61.9% |

| Hawaii | 61.8% |

| Nevada | 61.2% |

| California | 55.8% |

| New York | 53.3% |

| District of Columbia | 40.2% |

West Virginia had the highest homeownership rate in 2023, with 77% of households owning their homes.

One key factor behind West Virginia’s high ownership rate is its relative affordability. The state consistently ranks among those with the lowest median home sale prices, and it has the lowest home price-to-income ratio in the country.

Additionally, the state’s largely rural landscape and lower population density may contribute to its high homeownership rate, as housing availability is less constrained than in densely populated urban markets.

In contrast, states with the lowest homeownership rates such as Hawaii, California, and New York, also have some of the highest home prices and home price-to-income ratios, making ownership less attainable.

Places like New York and Calfornia also face high demand in urban centers, a greater share of renters due to job concentration and lifestyle preferences, and tend to have stricter zoning regulations.

This pattern highlights that while affordability plays a significant role, homeownership rates are also influenced by factors like housing supply, economic opportunities, and regional job markets.

Learn More on the Voronoi App ![]()

Learn more about U.S. real estate in this this graphic, which visualizes the annual nominal change in house prices by state as of the first quarter of 2024.

The post Mapped: Homeownership Rates by U.S. State appeared first on Visual Capitalist.