Consumer Confidence: Democrats Expect "Deep Recession", Republicans Look To New Golden Age

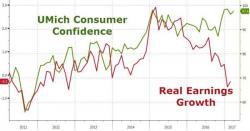

UMich consumer confidence rose in the preliminary March print, beating expectations at 97.6 with current conditions surging but expectations stalling somewhat.

This exuberance is occurring as real earnings growth slumps. But crucially, the partisan divide is unprecedented.

The overall level of consumer sentiment remained quite favorable in early March due to renewed strength in current economic conditions as well as the extraordinary influence of partisanship on economic prospects.