12 Reasons Why The Fed Just Made The Biggest Economic Mistake Since The Last Financial Crisis

Authored by Michael Snyder via The Economic Collapse blog,

Authored by Michael Snyder via The Economic Collapse blog,

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

Authored by Lance Roberts via RealInvestmentAdvice.com,

Future’s So Bright, We Gotta Hike Rates

“The simple message is the economy is doing well. We have confidence in the robustness of the economy and its resilience to shocks.” – Janet Yellen, March 15, 2017.

Really?

It seems Yellen's desperate attempt to tell the world that the US economy is doing fantastic BUT not well enough to raise rate more than 3 times appears to have let stocks hope down. Combine that with ECB comments and uncertainty over Trump's budget and the political 'put' rallied as stocks sank...

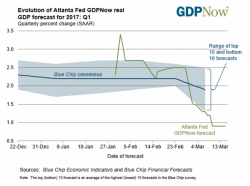

We're gonna need some more hawkish jawboning - as economic growth expectations collapse - to rescue this one...

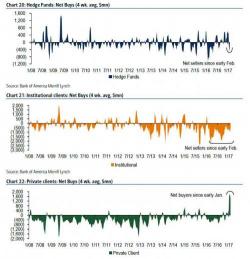

Q1 2017 will likely be the weakest period for economic growth of any rate hike since 1980; stock market earnings expectations are tumbling; uncertainty about the Trumpian pillars of stock market strength are surging, and various 'risk-on' asset classes around the world and breaking bad.

As RBC's macro strategist Mark Orsley previously remarked, something has dramatically, and suddenly changed in the market in recent days, as confirmed by bank's macro model provider. To wit: