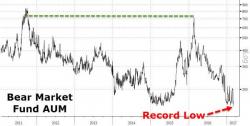

'Cash On The Sidelines' Crashes Near Record Lows

With hedge fund liquidity (and their ability to absorb any market shock) at record lows, it seems retail investors are also all-in on stocks. As Ned Davis Research points out, total cash holdings for funds at lowest in 19 years.

In a Ned Davis calculation that treats the global investment portfolio as an amalgamation of stocks, bonds and cash, the latter now makes up about 17 percent of investor portfolios, less than half of its allocation in 2009 and close to the lowest since 1980.