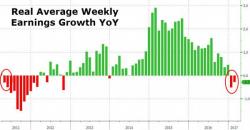

What Wage Growth? Real Earnings Tumble For Second Straight Month

Despite the surge in consumer confidence and exuberance at what lies ahead, real wages for America's average joes declined year-over-year in February (down 0.3%). This is the first consecutive monthly drop in real wages since 2011 (which forced Bernanke to to hint at and then unleash QE2 later that year).

So not only is The Fed hiking into the weakest GDP growth outlook since 1987, noiw they are hiking into declining real wage growth (something tht has previously driven The Fed to a massvely dovish stance).