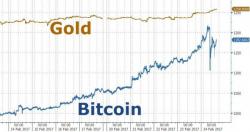

Good As Gold (Again)? Bitcoin Soars To New Record Highs

Bitcoin topped $1200 overnight for the first time, bringing it ever closer to the price for an ounce of gold...

As Bloomberg notes, a ten-day rally for the cryptocurrency has narrowed its gap with the precious metal to the smallest on record.

Each asset has been touted as an alternative to regular currencies, because of constraints on their supply and the capacity they offer to sidestep governments.

Partity looms once again...