LME Hands Gold Banks License to Print Money

The Banks Will Not Be Denied Franchises and are Buying Into Exchanges

written by Soren K. for MarketSlant

The Banks Will Not Be Denied Franchises and are Buying Into Exchanges

written by Soren K. for MarketSlant

Authored by Bonner & Partners Bill Bonner, annotated by Acting-Man's Pater Tenebrarum,

Exterminating Angel

Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation…

See, if you want to whip inflation now, you don’t need to do any of the really difficult things, such as printing less money… or God forbid, return to honest, market-chosen money (shudder!). All you need is intelligent nutrition!

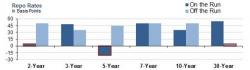

If Tuesday's 2Year auction surprised to the upside thanks to trading rather special in repo, and yesterday's 5Y auction was poorly received with no repo tightness, then today's 7Y auction of $28 billion in Treasuries was set to be the most disappointing of all, after it was trading at a generous +0.50% in the repo market.

And, predictably, when today's 7Y printed at 2.197%, the lowest yield since October (if above the previous six auction average of 1.883%) it tailed the WI of 2.196% by 0.1bp, as once again there were few overhanging shorts to squeeze.

First it was Ken Griffin, then Bill Ackman, now it's David Einhorn's turn.

Perhaps eager for a complete "change of scenery" after years of moribund returns, some of America's most prominent hedge fund managers are taking the metaphorical knife to their personal lives, and wives.

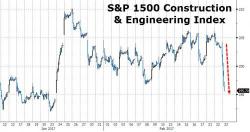

Construction, engineering and materials stocks are underperforming the market on sudden concerns that in addition to tax reform and Obamacare repeal, another core aspect of Trump's fiscal stimulus, Infrastructure spending, may be delayed by at least two years.