The WEF’s Stakeholder Capitalism Is Just Global Fascism By Another Name

By Brandon Smith

By Brandon Smith

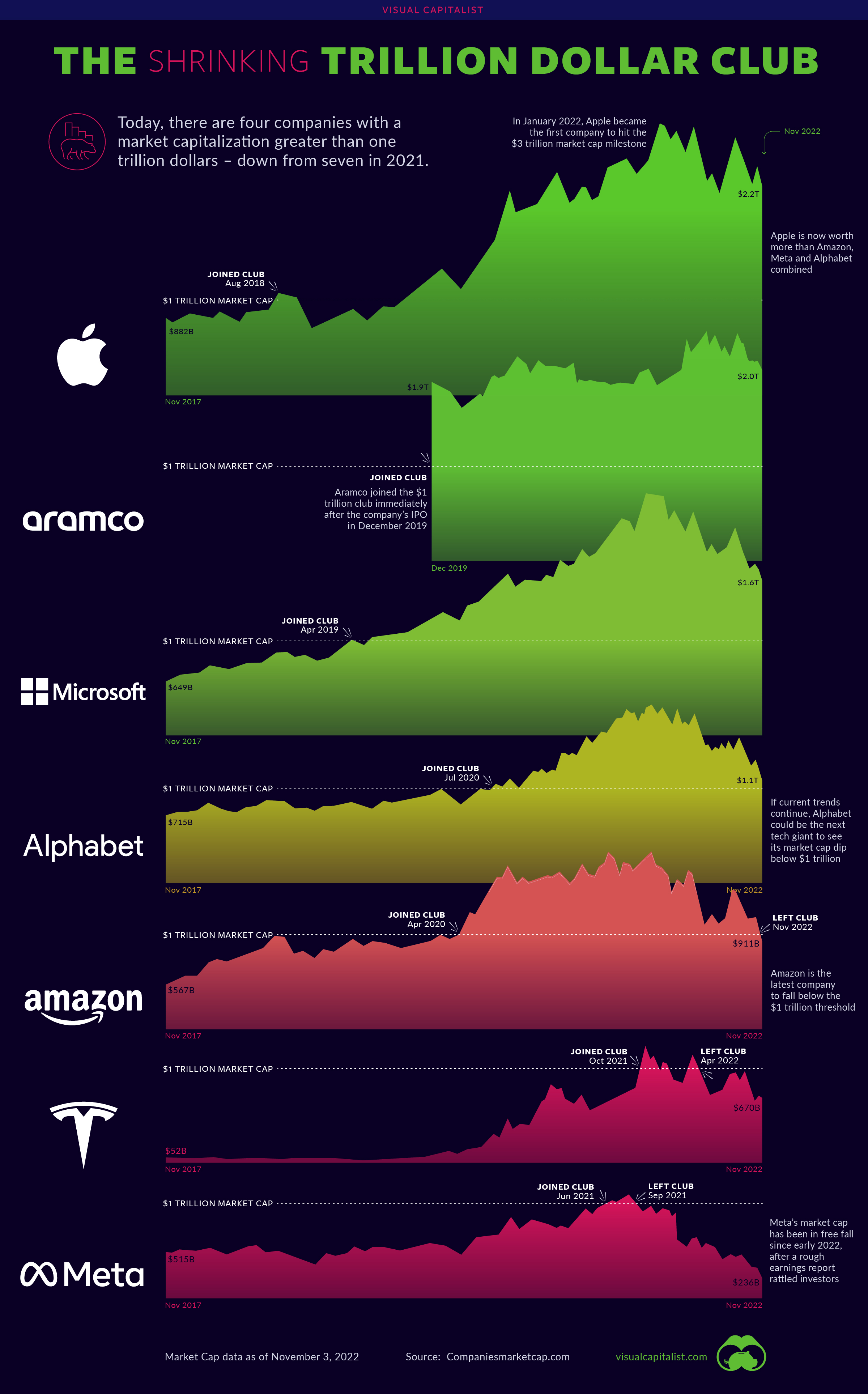

The Shrinking Trillion Dollar Club

Aggressive tightening from the Federal Reserve has caused tech stocks to plummet back to Earth in 2022, and this has shaken up the membership of the trillion dollar market cap club.

Here are the four current members of this exclusive club:

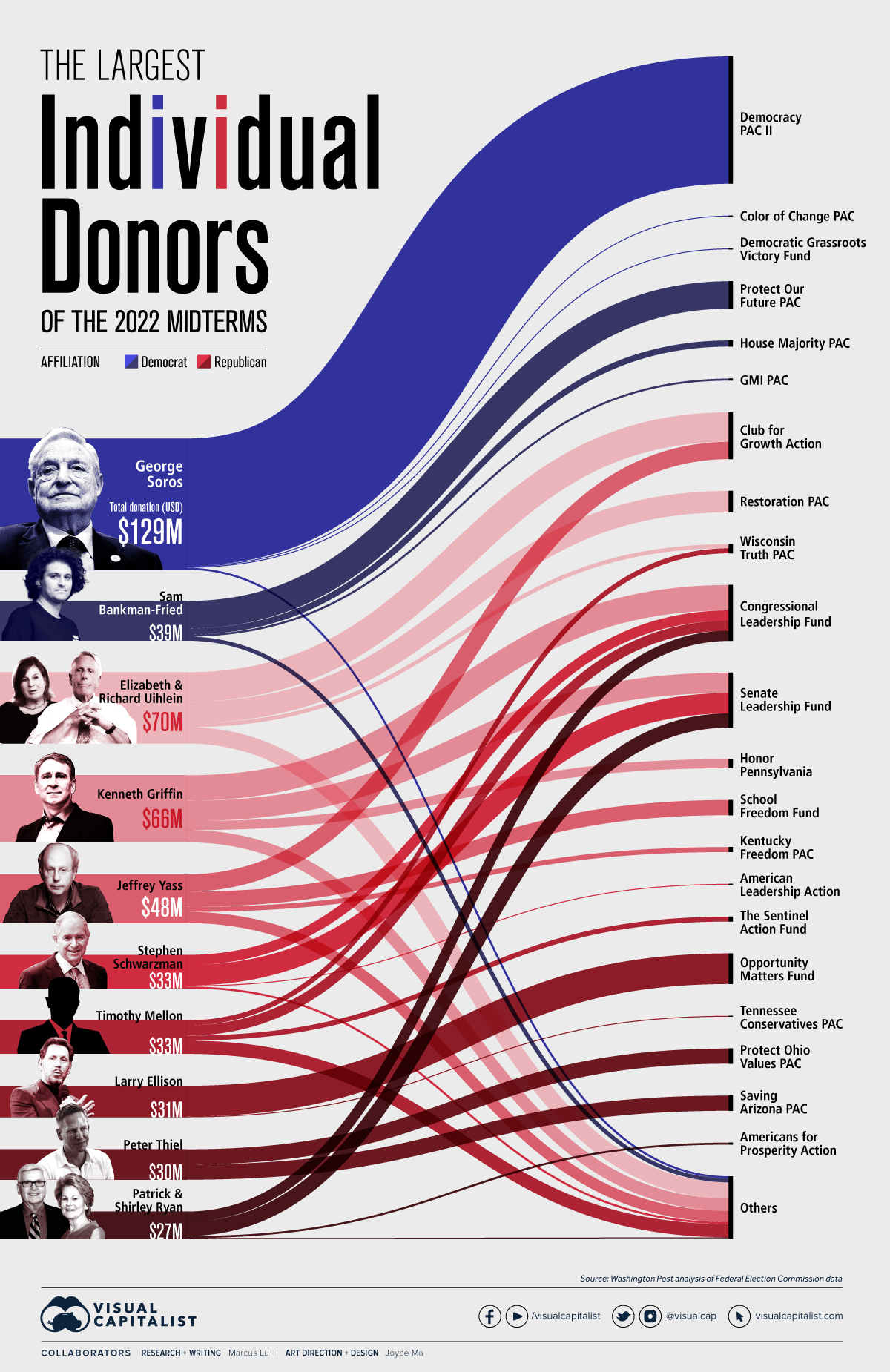

Visualized: The Biggest Donors of the 2022 U.S. Midterm Elections

This year’s midterm election is expected to set a new spending record, with over $9 billion being raised. This is significantly higher than the previous record of $7 billion, which was set in 2018.

Written By Niccolo Conte

Published November 2, 2022

•

Updated November 2, 2022

•

TweetShareShareRedditEmail

The following content is sponsored by Gold Royalty