Squeezing The Consumer From Both Sides

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Authored by 720Global's Michael Lebowitz via RealInvestmentAdvice.com,

Authored by Nick Cunningham via OilPrice.com,

The Trump administration is hoping to slash regulations on offshore oil drilling that were implemented after the 2010 Deepwater Horizon disaster that killed nearly a dozen people and led to an oil leak that spewed for months.

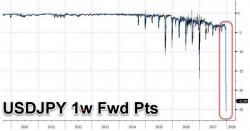

Over the past week we have shown on several occasions that there once again appears to be a sharp, sudden dollar-funding liquidity strain in global markets, manifesting itself in a dramatic widening in FX basis swaps, which - in this particular case - has flowed through in the forward discount for USDJPY spiking from around 0.04 yen to around 0.23 yen overnight. As Bloomberg speculated, this discount for buying yen at future dates widened sharply as non-U.S.

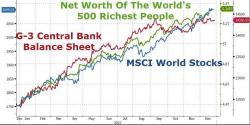

2017 has been a banner year for the world’s richest individuals.

Pumped by a tidal wave of central-bank driven liquidity and corporate buybacks, equity indexes around the world climbed to all-time highs this year – a phenomenon that has disproportionately benefited the world’s wealthiest, particularly the 500 individuals included in Bloomberg’s billionaires index.

By the end of trading Tuesday, Dec. 26, the 500 billionaires controlled an aggregate $5.3 trillion, a $1.1 trillion increase from their holdings on Dec. 27 2016.

By Nicholas Colas via DataTrekResearch.com,

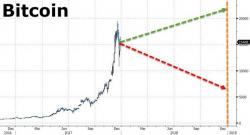

When you see something titled “Bitcoin 2018 Predictions”, you are probably most interested in just one thing: “Where will it go?” So let’s start there, but then add some other observations on a variety of topics.

#1: We expect bitcoin will trade for between $6,470 and $21,600.

Here’s how we get there: