Woke Twitter Elitists Are Too Stupid To Realize Elon Musk Is Saving The Platform

By Brandon Smith

By Brandon Smith

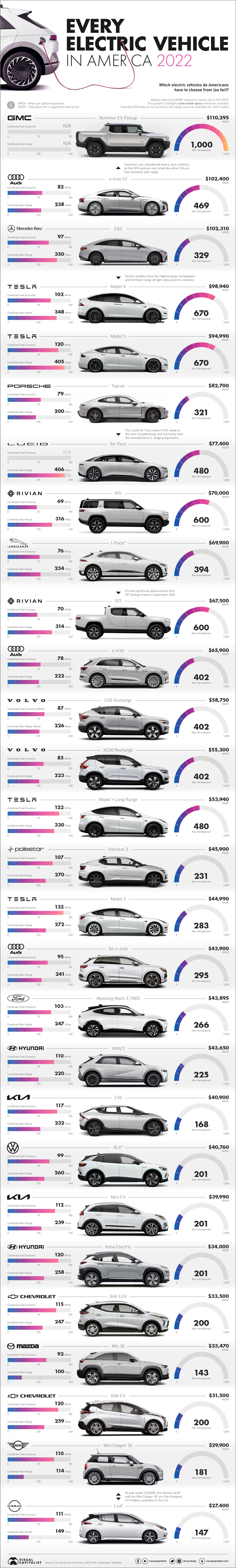

Visualizing All Electric Car Models Available in the U.S.

America’s electric vehicle (EV) market has surged over the last decade, and it’s only expected to grow further. The Biden administration has allocated billions towards the EV transition in the hopes that by 2030, electric cars make up 50% of all new cars sales in America.

Given the rising demand, what types of electric car models are available for U.S. consumers to choose from today?

By Brandon Smith

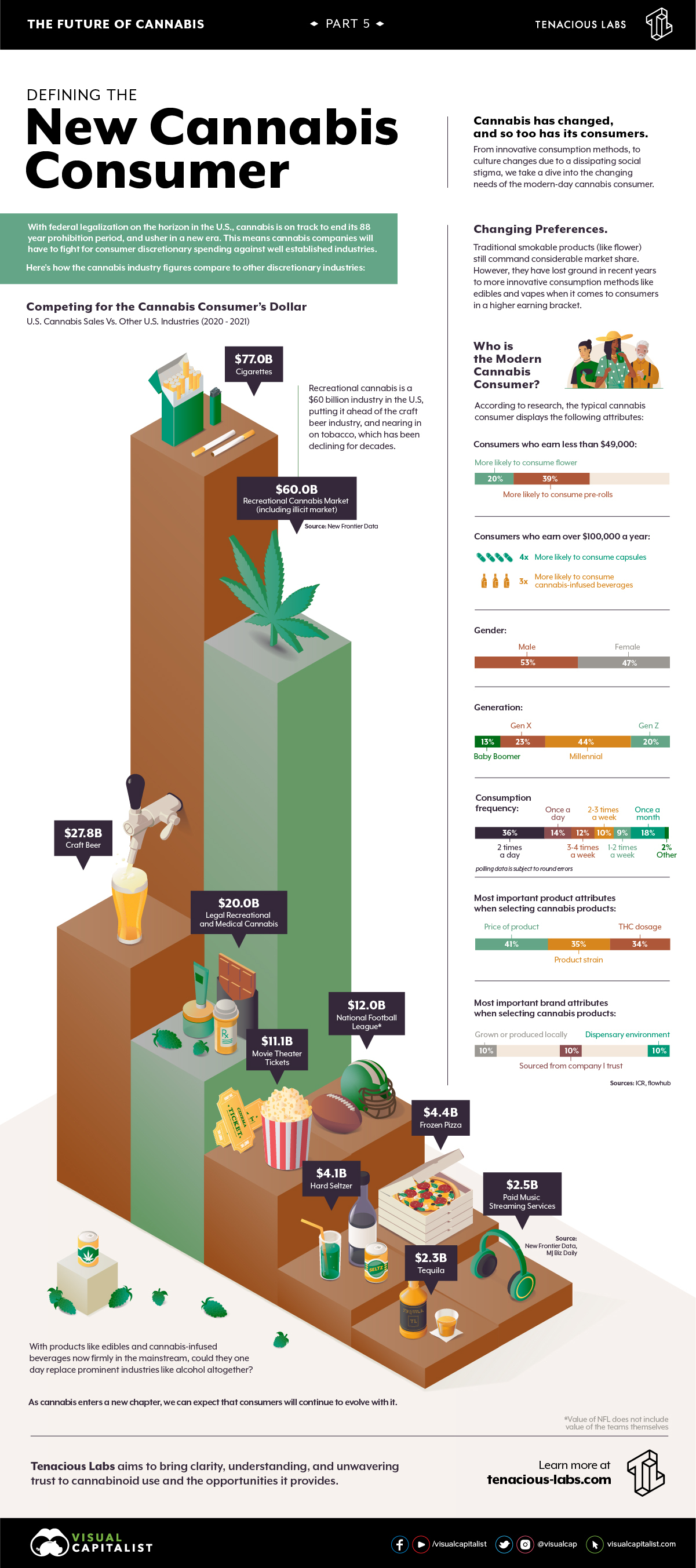

The following content is sponsored by Tenacious Labs

Defining The New Cannabis Consumer

The cannabis industry is transforming, and so too are its consumers.

As they edge further into the mainstream, cannabis companies will need to fight for the consumer’s dollar—not just against other cannabis brands, but also against a number of other industries in the discretionary spending sphere.

Subscribe to the Elements free mailing list for more like this

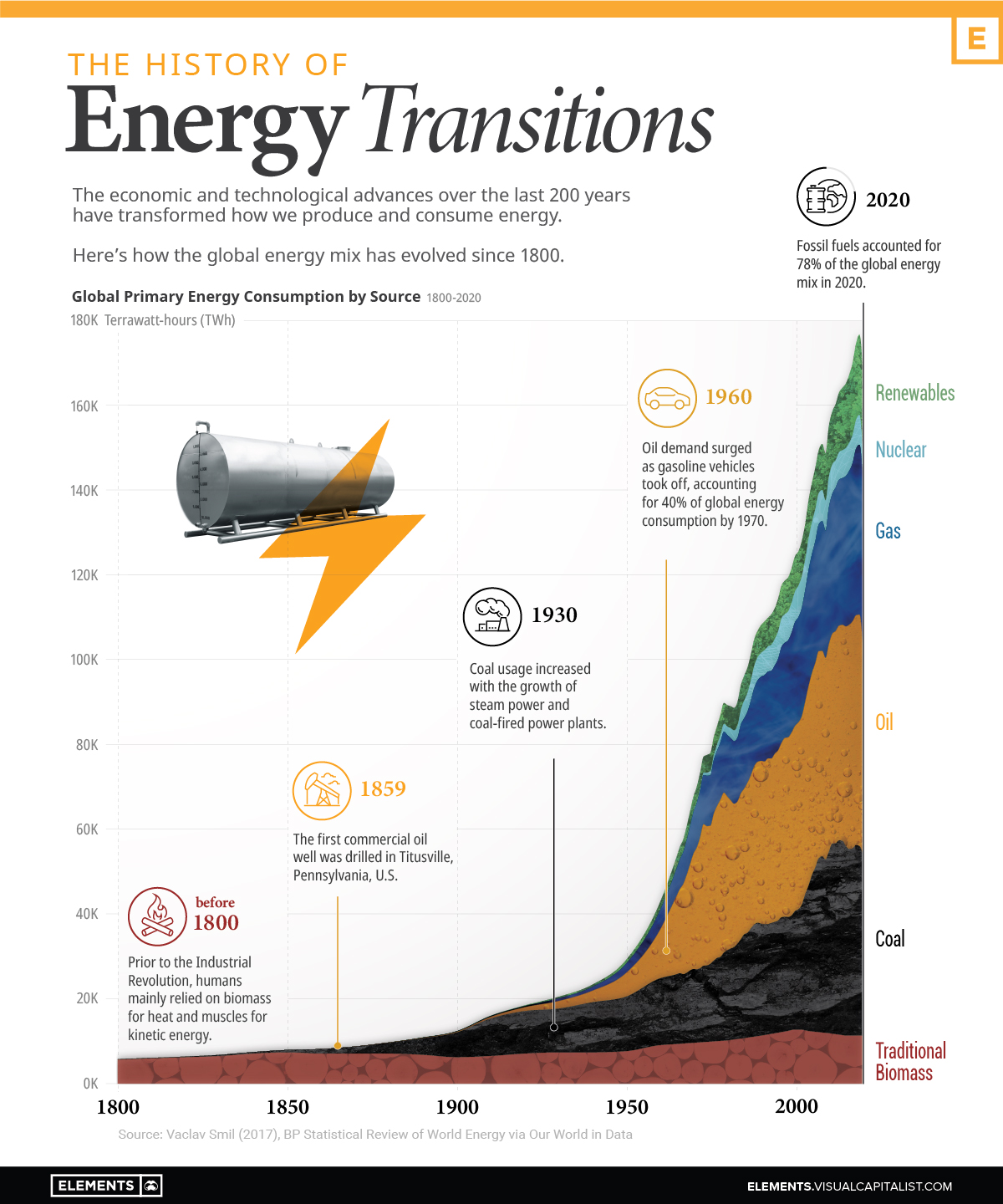

The History of Energy Transitions

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

Over the last 200 years, how we’ve gotten our energy has changed drastically.