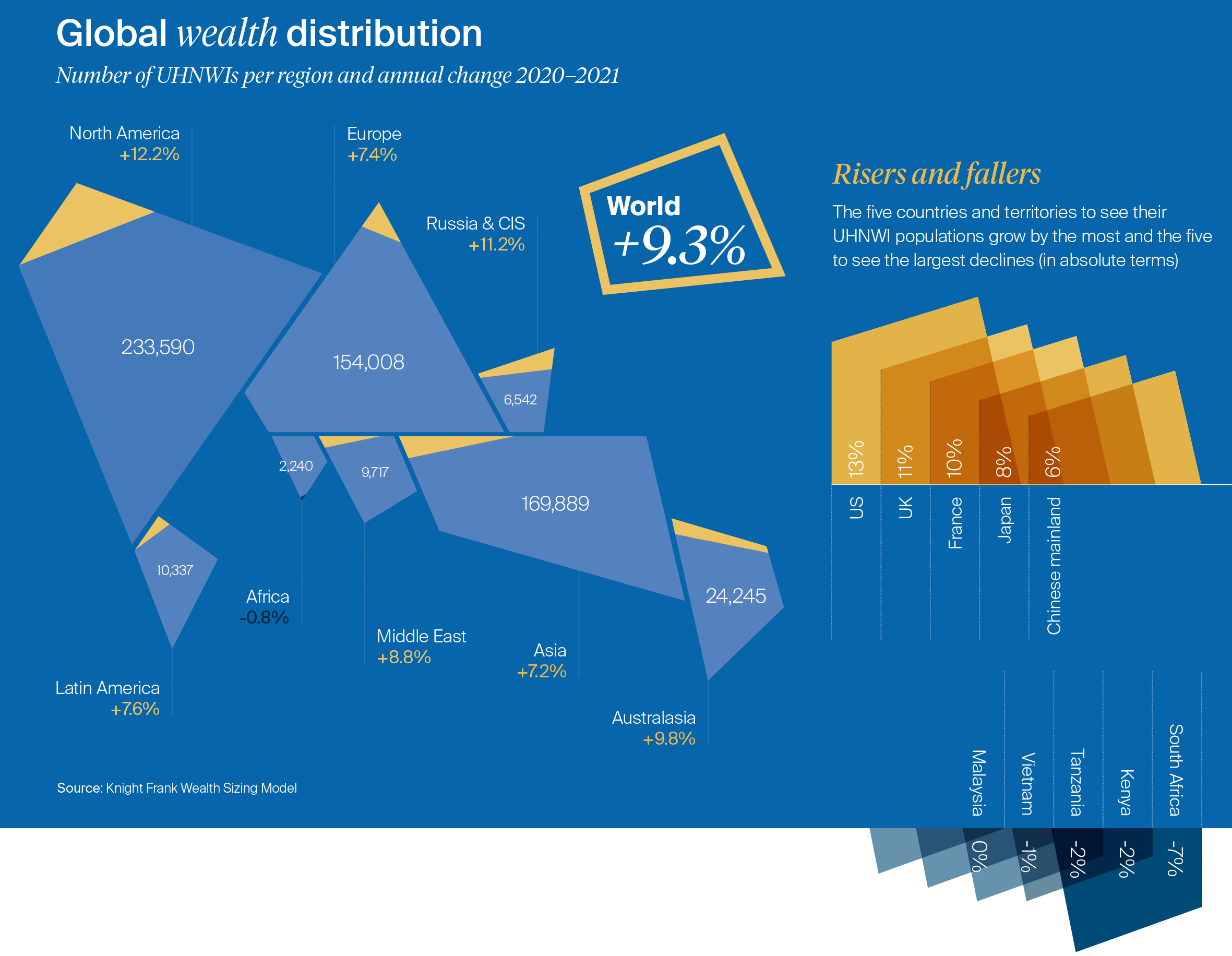

Where Does the World’s Ultra-Wealthy Population Live Today?

Where Does the World’s Ultra-Wealthy Population Live Today?

The pandemic, geopolitical tensions, and supply chain disruptions have thrown the world into disarray in recent years, but that hasn’t stopped the world’s ultra-wealthy population from growing at a strong clip.