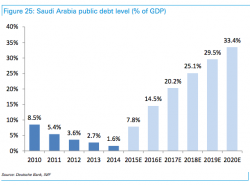

Saudi Arabia Admits To A Full-Blown Liquidity Crisis: Will Pay Government Contractors With IOUs, Debt

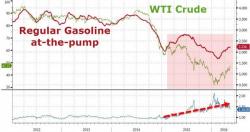

Previously we documented that as a result of the still low oil prices, largely a result of Saudi Arabian strategy to put high cost producers out of business and to remove excess supply, none other than Saudi Arabia has been substantially impacted, with the result being dramatic state budget, a sharp economic slowdown and mass worker layoffs.

Just three weeks ago we reported that the biggest construction conglomerate in the middle east, the Saudi Binladin Group had announced it would layoff 50,000 workers ot a quarter of its workforce, slammed by the weak economy.