Goldman Compares Elon Musk To Steve Jobs And Henry Fords, Upgrades Tesla To "Buy" With $250 Price Target

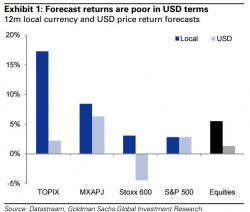

Just hours after Goldman unexpectedly weighed in bearishly on stocks, tactically downgrading global equities to Neutral over the next 12 months "on growth and valuation concerns" adding that "until we see sustained earnings growth, equities do not look attractive, especially on a risk-adjusted basis" in what some see as a potential upward inflection point in the market now that the biggest taxpayer backed hedge fund is buying what its clients have to sell, Goldman decided to unveil another surprise this time upgrading one of the biggest momentum/growth stocks, Tesla, to a buy with a $250 pr