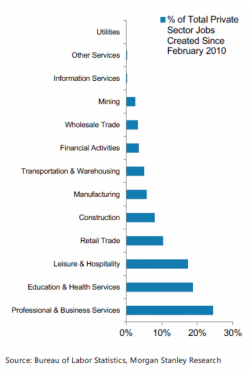

Morgan Stanley Agrees That This Is The Problem With The Jobs "Recovery"

One problem with the jobs "recovery" that many people still can't quite figure out, is if jobs are growing, why are wages relatively flat.

As we have explained on numerous occasions, the jobs that have been created can largely been divvied up between leisure and hospitality (our waiter and bartender chart should be familiar to all regular readers of this site), and part-time help, with any wage growth being found at two extremes instead of broadly based throughout the spectrum, as Matt King recently pointed out.