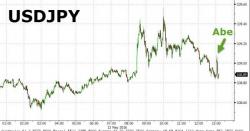

Is A "Lehman-Style Shock" Coming: Abe Announces Sales Tax Delay

Over the past several months, a recurring topic about Japan's economy has been whether Abe would delay Japan's planned consumption tax due in April 2017.

Over the past several months, a recurring topic about Japan's economy has been whether Abe would delay Japan's planned consumption tax due in April 2017.

The total US rig count declined yet again this week, down 9 to 406 - a new record low. The last four times rig counts collapsed anything like this, the US economy was in recession.

Oil rigs dropped 10 to a new cycle low at 318, but appear near a turning point if lagged oil prices remain any indication...

Or is US production about to fall off a cliff?

After some early selling - on the "great" retail sales data, bond yields are plunging now with the long-end dramatically outperforming with 2s30s 10bps flatter on the week so far...the biggest drop since August 2015

And stocks are starting to catch down...

What happens next?

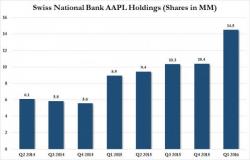

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL's biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake.

Last night, when previewing the most important macro event of the day - far more important than US retail sales which predictably tried to refute the gloomy reality reported by actual retailer CEOs - namely China's montly loan creation number, we said that "according to MarketNews, Chinese bank loan growth is expected to slow sharply in April compared with March as the pillar of bank lending, mortgage loans, slowed as the property market cooled." Citing bank officials, MNI said that combined new loans in April by the Big Four state-owned banks were more than halved from Mar