Another Headline Head Fake - The Consumer Can't Save The U.S. Economy

Submitted by David Stockman via Contra Corner blog,

Submitted by David Stockman via Contra Corner blog,

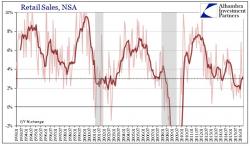

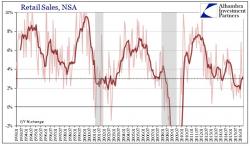

Another week goes by and another gaggle of Fed guffaws pukes out the same old 'we are data-dependent' meme, the same old 'everything is on track' narrative, and the same old 'bonds are wrong, stocks are right' idiocy. Do they not see what this constant nonsense has done to Kuroda and The Bank of Japan's credibility - propagandizing in the face of overwhelming facts. In order to help those who just can't seem to shake off the "well The Fed said it so it must be true" denial pysche, we offer the following chart...

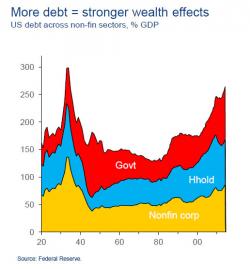

Long before McKinsey released its 2015 report which showed that, contrary to repeated, erroneous analysis and propaganda media reports, not only has the world not deleveraged at all but has added some $60 trillion in debt since the crisis (a number which mostly thanks to China is about $5 trillion higher over the past year) we warned that the primary reason why the world is unable to grow is because of an unprecedented mountain of debt that keeps growing.

By the SRSrocco Report,

The Global Financial Market took a big hit in 2015 and most investors have no idea why. The U.S. and global financial system both sit on a foundation that continues to erode each year. While the disintegration of the global financial substructure has been going on for many years, last year was a BIG ONE.

An oil spill from Royal Dutch Shell’s offshore Brutus platform released 2,100 barrels of crude off Louisiana’s coast in the Gulf of Mexico on Thursday. All drilling activities at Shell’s Brutus platform have been suspended. According to the U.S.